Marzo 11, 2010 EcoAnemia

Aggiornamento macro

La giornata di ieri ha avuto poco da dire sul fronte puramente tecnico – bull market al momento ancora ben saldo – mentre i dati macro non accennano affatto a migliorare.

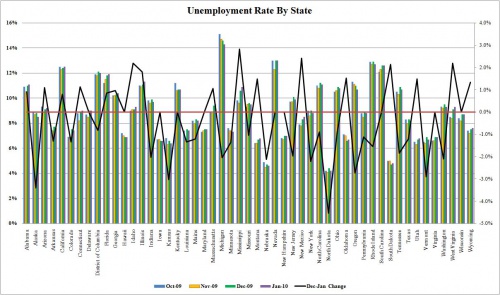

Disoccupazione ancora in forte ascesa :

The unemployment rate increased in 30 states, while somehow nonfarm payrolls increased in 31 states.

Presumably this is due to an increase in the total labor pool.

As reported, “Michigan again recorded the highest unemployment rate among the states, 14.3 percent in January.

The states with the next highest rates were Nevada, 13.0 percent; Rhode Island, 12.7 percent; South Carolina, 12.6 percent; and California, 12.5 percent.

North Dakota continued to register the lowest jobless rate, 4.2 percent in January, followed by Nebraska and South Dakota, 4.6 and 4.8 percent, respectively.

The rates in California and South Carolina set new series highs, as did the rates in three other states: Florida (11.9 percent), Georgia (10.4 percent), and North Carolina (11.1 percent).

The rate in the District of Columbia (12.0 percent) also set a new series high. In total, 25 states posted jobless rates significantly lower than the U.S. figure of 9.7 percent, 11 states and the District of Columbia had measurably higher rates, and 14 states had rates that were not appreciably different from that of the nation.”

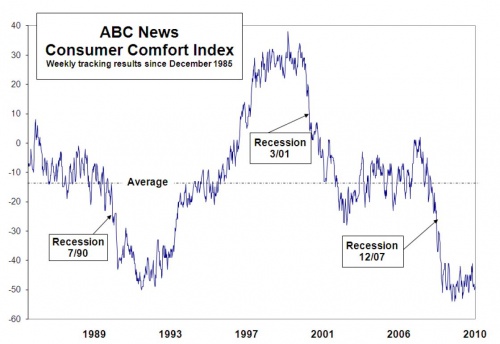

Mentre l’ABC Consumer Comfort Index continua a peggiorare :

Digging into the data reveals why the non-millionaires in America – those that do not have access to the government’s record excess liquidity – are just plain unhappy about the economy.

“The index’s individual components tell the story : Half or more Americans have rated their personal finances negatively in 91 of the last 97 weeks.

Già. mentre i massmedia – soprattutto nostrani – non fanno altro che osannare la attuale politica sociale della attuale amministrazione USA.

Nel frattempo, Fitch ci informa che le insolvenze nei pagamenti hanno raggiunto un nuovo record :

Upcoming maturities from U.S. CMBS deals originated in 2005 contributed to a 29 basis-point (bp) increase in delinquencies to 6.29% at the end of February, according to the latest U.S. CMBS delinquency index results from Fitch Ratings.

“Five-year loans originated in 2005 will continue to have difficulty refinancing this year as liquidity remains limited,’ according to Managing Director Mary MacNeill.

‘In many cases, sponsors will have to either contribute additional equity in order to refinance their loans or look to the servicers for extensions and modifications.”

Current delinquency rates by property type are as follows:

Office : 3.50%;

Hotel : 16.61%;

Retail : 5.09%;

Multifamily : 8.97%;

Industrial : 4.16%.

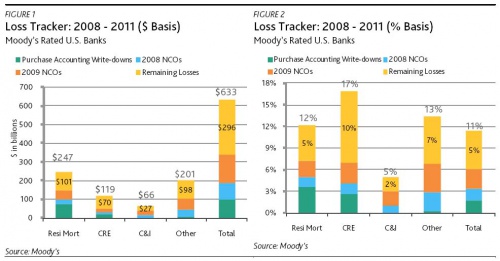

Mentre Moody’s ci avverte che – pur essendo probabilmente passato il peggio per le banche USA – nuovi problemi appaiono all’orizzonte :

Moody’s estimates that rated U.S. banks will incur $536 billion of loan losses between 2008 and 2011, equal to 9.7% of loans outstanding at December 31, 2007.

We have incorporated this amount into our views of banks’ capital adequacy and into our ratings.

This amount has been reduced for the purchase accounting marks taken on residential and commercial mortgage portfolios in recent acquisitions, including JP Morgan’s purchase of Washington Mutual, Wells Fargo’s purchase of Wachovia, Bank of America’s purchases of Countrywide and Merrill Lynch, and PNC’s purchase of National City.

On a gross basis (prior to the reduction by the purchase accounting marks), Moody’s loss estimate is $633 billion, or 11.4% of loans outstanding at December 31, 2007.

Essentially, we believe charge-offs equal to 1.7% of loans were eliminated through purchase accounting write-downs. Note that these estimates exclude securitized credit cards.

Mentre molta tristezza fa l’ultima iniziativa del governo greco, una colletta pubblica mondiale – con donazioni effettuabile tramite paypal- per il rifinanziamento ed il pagamento del debito pubblico :

Credo che questa iniziativa illustri più di ogni altra la situazione in cui versano le finanze elleniche in questo momento.