Luglio 8, 2010 EcoAnemia

Alpha is dead

Planned stress tests for European banks will cover their resistance to a crisis in the market for European sovereign debt, but not the scenario of a default of a Eurozone state since the EU would not allow such an occurrence.

In effetti siamo alle barzellette – non che sia una novità, beninteso.

Ed il commento di Zerohedge, molto piccato ovviamente , è assai appropriato :

So let’s get this straight – the very issue that is at the heart of the liquidity crisis in Europe, namely the fact that a bankrupt Greece has managed to destroy the interbank funding market in Portugal and Spain, and the other PIIGS, and has pushed EURIBOR and other money market metrics to one year stress highs, and forced the ECB to lend over $1 trillion to various central and commercial banks, will not be tested for ?

In effetti sono solo scuse per mandare avanti la baracca per un po’, e per fare rimbalzare violentemente gli indici dai minimi, sia pure con volumi sempre minori :

Il Dow torna sopra quota 10k, lo Spoore mira alla prima resistenza che è la ema200.

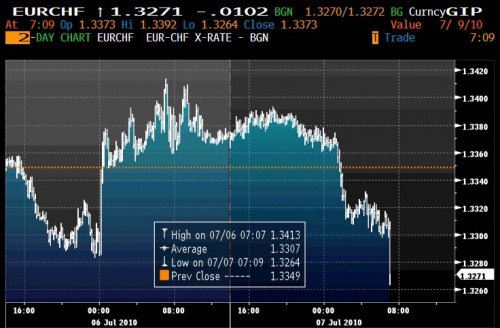

Intanto, la SNB si fa ancora viva a sostegno dell’€ :

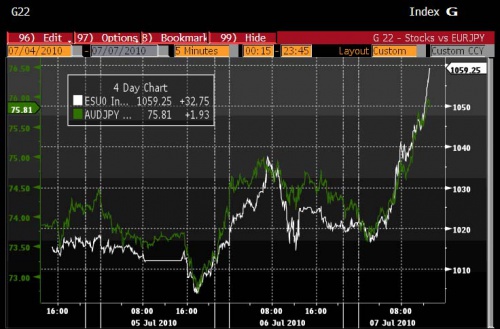

Mentre il carry-trade prosegue indisturbato :

Gli ultimi 10 punti di ieri dello Spoore (l’ultima ora) sono dovuti solo a questo, oggi la forbice si richiuderà subito in apertura, dopo si vedrà.

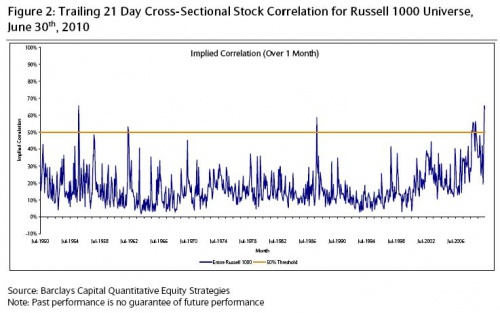

Questo è un mercato ormai alla deriva, senza alcuna correlazione possibile e soprattutto dove non solo lo stock-picking, ma anche le strategie da utilizzare sono diventate quasi inutili da un paio di mesi a questa parte, come giustamente riporta Matt Rothman :

It was hard to be a stock picker in the market for the last two months as the last two months have seen historically low levels of dispersion in stock returns.

The cross-sectional correlation across all stocks in the market was at its second highest level last month (measured back to July 1950) and recorded its third highest level this month ; there have never been to two months back-to-back with anything approaching these levels.

To belabor the obvious and put this in perspective, current levels of correlation are higher than in October 1987, anytime during the Fall of 2008, either therun-up or the bursting of the Internet Bubble, or after 9/11.

The reason this matters to all stock pickers — fundamental or quantitative — is because with stock return dispersions at all-time lows, it is extraordinarily difficult to be picking stocks.

Di conseguenza, questo è quello che prima o poi succederà :

The danger of yet another systemic meltdown (or up), now that everyone is on the same side of the trade (and whoever isn’t, is getting steamrolled), is higher than ever in history, up to and including May 6.

Ci sarebbe stato bisogno di una vera riforma finanziaria che regolamentasse il tutto ma, come ancora riporta Zerohedge :

We finally have a financial reform bill, although it has more holes than a hunk of Swiss cheese.

There is no return of Glass-Steagall, no breakup of the big banks.

Crucial definitions, like one for “proprietary trading”, got lost in the Bermuda Triangle.

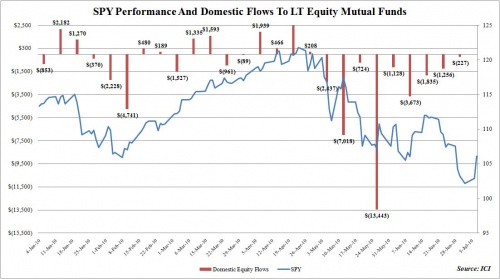

Nel frattempo, nona settimana di fila in cui fondi escono dai mercati :

That’s all.