Giugno 5, 2012 MacroEcoAnemia

Another bad analysis from Zerohedge

The EFSF/ESM hybrid cannot provide the cash for even half of Italy and Spain’s combined funding needs.

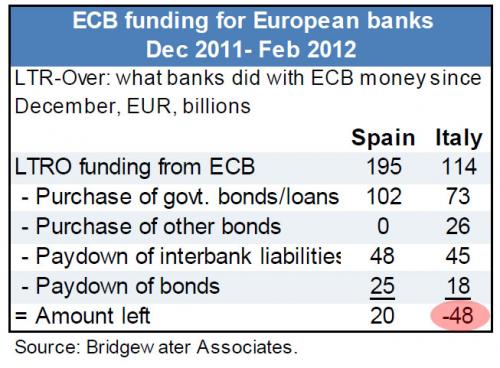

Now, Bridgewater is hitting Europe again, this time focusing attention where it is long overdue: Italy.

Fonte : Zerohedge

Zerohedge again proved to be the very bad copy of the interesting blog was once.

Italy doesn’t need banks to buy government bonds because the Italian government has always relied on Italian families to do that (ask Rigor Monti for info, which is why he introduced the hated tax called IMU ?)

Italian households have the lowest level of debt to income in the OECD (about 40% of income versus say 150% of debt to income in Australia, for example) and Italian households traditionally hold cash in their accounts (but big problems soon unsustainable for those who are heavily indebted for mortgages, of course).

So the “back of the envelope” calculations of these zerohedge morons mean nothing : the situation is completely different from Spain, where the banks are direct owners of real estate that has been devalued by at least 50% since 2007 (and for this reason now all of them must be fully recapitalized).

The Italian problem is only one : the flight of capital – huge and growing – abroad, due to unsustainable fiscal taxation, and consequently an economic and financial depression for all those who remain in the country.