Marzo 17, 2008 EcoAnemia

Apocalisse a Wall Street

Nessuno ne parla, ma questa notizia è terrificante.

[…]MF Global Ltd. (MF) said it is “very well capitalized” and has “sufficient funding to conduct our business in normal course,” responding after market worries cut the company’s value by as much as 79%.

The news also helped send shares of commodity exchanges and brokers sharply lower.”

As of today, volumes and net revenues for the current quarter to date remain at higher levels than in any comparable period during the current fiscal year,” MF Global said in a statement.

The company added that client funds are “at higher levels” than when a scandal, involving a massive wheat-market play gone awry, was announced last month.

MF Global went on to say, “While the company uses third party repo lines, we have alternative funding in the event those lines are not available to the company.”

They include a $1.4 billion credit line on which it hasn’t drawn.Clearing houses in London and the U.S. said MF Global continues to meet all its obligations as rumors swirled that the company is having problems meeting its margin payments. […]

[…]MF Global last month revealed a $141.5 million loss from unauthorized trades in the booming wheat market by one of its traders, blaming the loss on loopholes in its system limiting the size of its trades. […]

Spun off from hedge-fund firm Man Group PLC last summer, MF Global is a big provider of trading services on fast-growing markets like CME Group Inc.’s (CME) Chicago Mercantile Exchange, Nymex Holdings Inc.’s (NMX) New York Mercantile Exchange and Eurex, Europe’s largest derivatives market[…]

MF Global è il più grande broker al mondo per i derivati : commodities, opzioni, indici, CFD.

La maggior parte delle banche primarie del globo usano MF come broker primario.

Ha praticamente sedi in tutti i continenti, è il player numero 1 al mondo per contratti al CBOT, CME, COMEX, NYMEX (quindi l’intero mercato dei derivati USA), il numero 1 all’Euronext Liffe ed il numero 2 all’Eurex (quindi è anche nettamente il top player per l’Europa).

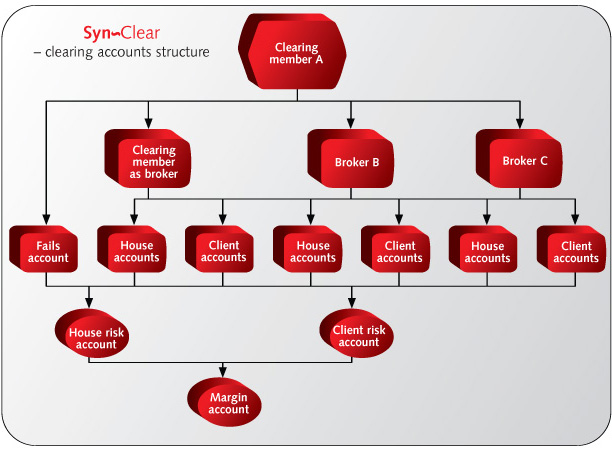

E’ clearing house praticamente di tutte le principali firme europee, compreso naturalmente quelle italiane.

Chiunque lavori professionalmente in questo campo utilizza MF Global, direttamente od indirettamente.

Infatti è pure il mio broker primario.

Se risultasse insolvente, sarebbe un disastro finanziario mostruoso, perchè chiunque avesse posizioni aperte in derivati non troverebbe più la controparte (compreso chi ha investito in materie prime).

Appare evidente che in qualche modo la situazione verrà risolta.

Rimane sempre il fatto che tutto quello che sto vedendo assomiglia sempre di più ad un film dell’orrore.