Marzo 29, 2010 EcoAnemia

Appunti da dietro le quinte

Giornata molto interessante quella di venerdì.

Iniziamo dallo Spoore, che prima ha rotto il canale ascendente, per poi recuperarlo rapidamente dopo poche ore :

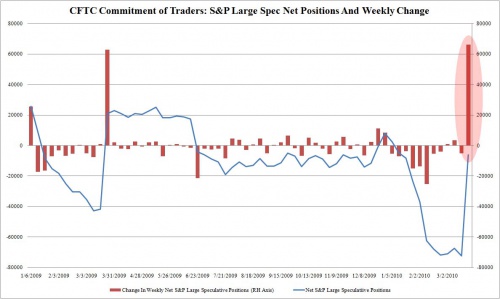

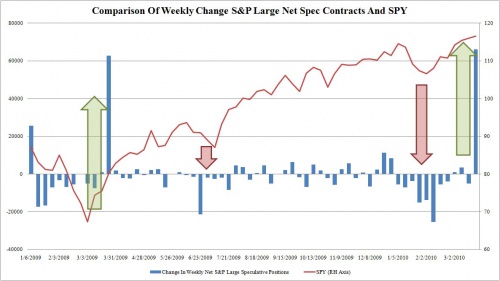

Ma se guardiamo l’andamento settimanale dei volumi fornitoci dal CFTC, possiamo notare un importantissimo fatto :

This tracks the S&P Large contracts (x 250).

Last week saw the single biggest weekly short cover in the history of this data set, indicating one of several things:

Some large fund(s) capitulated and covered a major short position.

The ongoing forced short buy-ins by the State Streets of the world have finally yielded results.

Someone is positioning for a massive move higher in the market by going net short to neutral.The net weekly change in contracts of 66,043 is a record, and involves a staggering amount of capital: the money involved is 1,150x250x66,000 or roughly $19 billion.

A weekly move of this magnitude was only ever seen once before, on March 24, 2009, when the government had to cement the bottom of the market following the 666 low.

As the Large uses Open Outcry, it explains why we were getting numerous emails from pit traders indicating that Goldman was buying up billions worth of S&P Large.

I grafici sono assai eloquenti :

Definitiva capitolazione del mercato, con spike al rialzo in arrivo, oppure inversione di tendenza e correzione piuttosto marcata ?

Sarà davvero interessante vedere quello che succederà nelle prossime settimane.

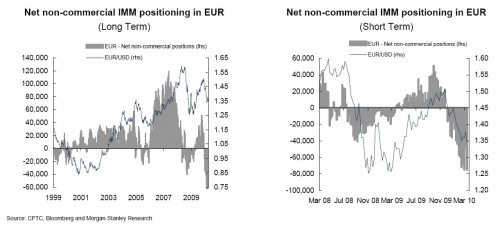

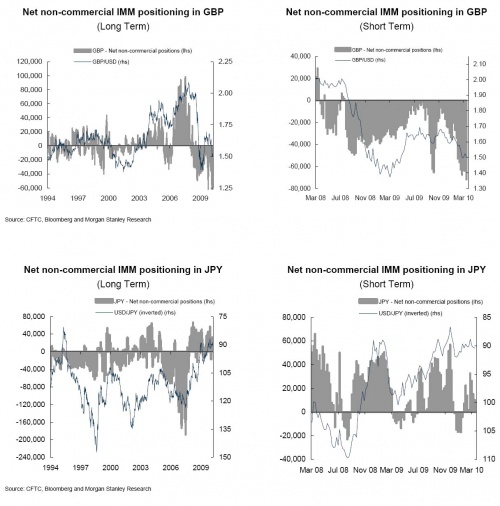

E nel fronte valutario, interessante notare questo :

The euro is back to having a record number of non-commercial futures-only positions at -74,917.This is a more than 50% increase from last week’s -46,341. As a reminder the prior euro net short record was -74,551 two weeks ago.

Curiously, even as traders went bearish on the euro, this was not coupled by a carry offset with the JPY: net long spec yen positions dropped from 15,197 to 10,161.

Another currency that saw an increase in bearish interest was the cable, which saw a 7,637 contract decrease to -71,624.On the bullish side, the AUD was the preferred contra-carry currency, as contracts increased by 10,161 to 74,339.

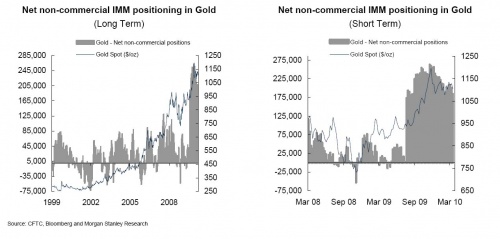

In other commodities, both oil and gold saw speculative positions declines by -12,224 and -16,474, respectively, to 111,919 and 183,872.

Riguardo il Gold, pare che il FMI abbia accantonato l’idea di vendere una parte della quantità in suo possesso :

“I just spoke with Eric Sprott, who bid to buy [the IMF’s remaining gold on the block] and they refuse to sell it.”As Kitco points out, “the IMF might be holding out for a bigger buyer or a central bank or for higher prices.But Holmes argues the IMF’s rejection of Sprott’s bid means markets are being manipulated.”

Back to Holmes: “I think there is a lot of manipulation done by governments around the world in the currency markets which affect the bond markets so to me it’s just normal course.

Nulla di nuovo anche qua, naturalmente, ma è sempre interessante conoscere l’opionione dei veri market makers, questo significa che il FMI fino ad ora ha bluffato (ma avevamo dei dubbi a riguardo ?) e che stima di vendere una parte delle quote in suo possesso almeno il 20% più in alto, fra i 1300$ ed i 1500$.

Fra l’altro, la situazione geopolitica ogni giorno che passa sembra diventare sempre più calda :

Several South Korean sailors were killed and one of its naval ships with more than 100 aboard was sinking on Friday after possibly being hit by a North Korean torpedo, South Korean media reported.A South Korean vessel fired at an unidentified vessel towards the north and the South’s presidential Blue House was holding an emergency security meeting, Yonhap news agency said.

South Korea’s YTN TV network said the government was investigating whether the sinking was due to a torpedo attack by the North.The network also quoted a government source saying it was unclear yet whether the incident was related to North Korea.”We are currently focusing on rescuing people,” the source said.

Successivamente è stata stabilità l’estraneità dai fatti – almeno ufficialmente – della Korea del Nord, ma il nervosismo rimane palpabile.

Ma soprattutto :

The powerful blast shook the city’s Patissia district at around 1950gmt.

“A man is dead and a girl was injured but she is not in danger,” a police official said.The girl was rushed to a nearby hospital.The building which was targeted is an institute used for training public officials

.Police are investigating whether the person killed had been carrying the explosive.

Non certo una notizia tranquillizzante.

Ma naturalmente per gli USA è tutto ok, anzi , a loro non pare vero – a dispetto delle dichiarazioni di facciata – difendere uno scenario in cui la loro politica militare è cosa buona e giusta :

This classified CIA analysis from March, outlines possible PR-strategies to shore up public support in Germany and France for a continued war in Afghanistan.

After the Dutch government fell on the issue of dutch troops in Afghanistan last month, the CIA became worried that similar events could happen in the countries that post the third and fourth largest troop contingents to the ISAF-mission.

The proposed PR strategies focus on pressure points that have been identified within these countries.

For France it is the sympathy of the public for Afghan refugees and women.

For Germany it is the fear of the consequences of defeat (drugs, more refugees, terrorism) as well as for Germany’s standing in the NATO.The memo is a recipe for the targeted manipulation of public opinion in two NATO ally countries, written by the CIA.

L’intero documento è possibile leggerlo qua :

Afghanistan.pdf