Aprile 14, 2010 EcoAnemia

Arrivano le conferme del feudalesimo economico

Ieri è stata la giornata di Intel che non ha deluso un mercato che attendeva conferme sul fronte delle trimestrali :

Intel released their earnings report for Q1 2010 or the period ending March 27th 2010.

Intel was expected to report earnings of about 38 cents a share on revenue of $9.8 billion. Instead, they reported earnings of 43 cents a share on revenue of $10.3 billion

Numeri oggettivamente molto buoni, ed ora si attende giovedì sera una conferma da un altro gigante, Google, che nell’attesa avanza (sell the good news ?).

E se le multinazionali continuano a fare utili su utili, un’altra conferma del pericolosissimo meccanismo di feudalesimo economico che si sta instaurando la abbiamo dall’aggiornamento sulle condizioni della piccola e media impresa USA, il NFIB :

NFIB Small Business Confidence Drops To 8 Month Lows .

The NFIB Small Business Optimism index came in at 86.8, a decline from the March’s read.

As the NFIB itself confirms: “The persistence of index readings below 90 is unprecedented in survey history.“The March reading is very low and headed in the wrong direction,” said Bill Dunkelberg, NFIB chief economist.

“Something isn’t sitting well with small business owners.Poor sales and uncertainty continue to overwhelm any other good news about the economy.

The index has posted 18 consecutive monthly readings below 90. In March, nine of the 10 Index components fell or were unchanged from February’s not-so-great readings.”

As for credit condition : “Regular NFIB borrowers (35 percent accessing capital markets at least once a quarter) continued to report difficulties in arranging credit.

A net 15 percent reported loans harder to get than in their last attempt, up three points from February.

However, 89 percent of the owners reported all their credit needs met or they did not want to borrow.”

Nessuna novità, naturalmente, la situazione dell’economia reale per la piccola e la media impresa è questa, e non gli scintillanti indici delle multinazionali che hanno denaro a costo zero dalle banche centrali.

E per gli USA, da segnalare inoltre un ulteriore peggioramento sul fronte deficit :

After reporting a $40 billion trade deficit in January, the US once again was a net importer to the tune of $39.7 billion.

This is worse than the $38.5 billion consensus.

Both import and export prices increased by 0.7% ( with an import price consensus of +1.0% ).The largest deficit increase was in the consumer goods category, which increased by a sizzling 3.1% .

Molto ironico – ma giusto – il commento di Zerohedge a riguardo :

As everyone is stockpiling Kindles and iPads for that moment when the irresistible force of the US budget deficit finally meets the immovable object of reality (which lately has been quite movable).

The next question: with China now also a net importer, and joining such illustrious peers as the US and EU, just who is exporting ?

Domande a cui è difficile dare in effetti una risposta nei canoni “classici”.

Anche questo un altro effetto della globalizzazione.

Nel frattempo, in Europa nulla di nuovo, con Atene che (ovviamente) torna in difficoltà dopo due giorni dal primo bailout :

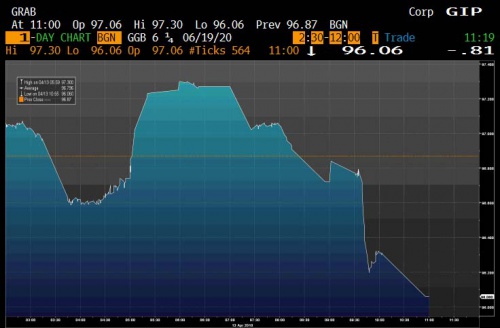

Greece Prices Upsized Bill Auction At Record Yields

The government sold 780 million euros ($1.06 billion) of 26-week bills at a yield of 4.55 percent, attracting bids for 7.67 times the securities offered, the nation’s Public Debt Management Agency said today in Athens.

Greece also offered 780 million euros of 52-week securities at a yield of 4.85 percent, with a bid-to-cover ratio of 6.54 times. In January, the 52-week bills were sold to yield 2.2 percent.

Pare quindi ancora una volta che il bailout non abbia convinto fino in fondo.

Nel frattempo,ieri ancora una volta l’ASE ha stonato in un coro all’unisono rialzista : -2%, con tutte le banche elleniche come Alpha, Piraeus e soprattutto National Bank of Greece pesantemente vendute (tutte almeno sotto del 5%) :

Pare inoltre che i principali attori del salvataggio siano stati Sarkozy e Berlusconi (insieme a Trichet), mentre la Merkel – anche per questioni elettorali, da leggersi elezioni regionali tedesche – si sia opposta fino alla fine :

Germany, supported by Austria and the Netherlands, insisted that Greece would only be allowed to borrow money at 6 to 6.5 percent market rates. Other countries, which found 4.5 percent more reasonable, moved quickly.

“Between phone calls, the French and Italian presidents met face to face.

They worked out a deal with ECB chairman Jean-Claude Trichet that would entail Greece paying around 5 percent interest over bilateral loans from all other European countries.

This is higher than the rate the ‘super strict’ IMF usually charges, but far less than the interest Greece was paying by the end of last week.

Sarkozy and Berlusconi did not want to wait any longer for the Germans who, they feared, wouldn’t start showing some leniency until May, after the German regional elections, which chancellor Angela Merkel intends to win.

Merkel also objected to the 16 euro zone countries taking a decision, and kept insisting all 27 EU member states got involved.

The French and Italians reportedly agreed that they could be first to offer Greece loans, granting Merkel some more time.

Merkel thus lost the initiative she had held in the Greek bail-out debate for months.

It wasn’t until Sarkozy, Berlusconi and Trichet sealed their secret deal on Thursday night that she understood the gig was up, and she dropped her demand for a 6 percent interest rate.

To offer Merkel a graceful exit, Juncker talked down the importance of the 5 percent interest rate on Sunday, calling it “anything but a subsidy”.

After all, there are a lot of Greek state bonds sitting in German banks.

Nel frattempo, il DXY ha perso la media a 50gg , iniziando molto probabilmente una fase laterale.