Marzo 24, 2010 EcoAnemia

Avanti Savoia

Il bull market prosegue indisturbato nella sua corsa, incurante – ovviamente – delle notizie negative che arrivano dal fronte macro :

Dow e Spoore, poco da dire per il momento sulla loro direzione.

E rispetto a qualche mese fa, quello che cambia – come fatto notare più volte – è che in troppi stanno vendendo allo scoperto sui massimi, alimentando di fatto un bull market che altrimenti sarebbe senza volumi.

Senza le vendite allo scoperto si andrebbe lateralmente, of course.

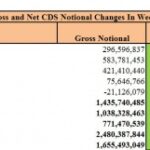

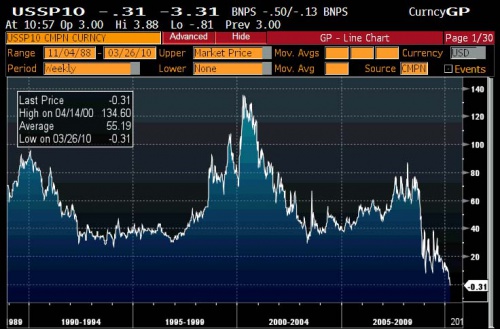

Nel frattempo i 10 Year Swap Spreads sono passati in territorio negativo :

Ed infatti è interessante notare questo fatto :

The gap between the rate to exchange floating- for fixed- interest payments and comparable maturity Treasury yields for 10 years, known as the swap spread, narrowed to as low as negative 0.44 basis point, the lowest since at least 1988. The spread narrowed 3.38 basis points to negative 0.38 basis point at 12:40 p.m. in New York.

A negative swap spread means the Treasury yield is higher than the swap rate, which typically is greater given the floating payments are based on interest rates that contain credit risk, such as the London interbank offered rate, or Libor.

The 30-year swap spread turned negative for the first time in August 2008, after the collapse of Lehman Brothers Holdings Inc. triggered a surge of hedging in swaps.

The difference narrowed to negative 18.56 basis points today.

Debt issued by financial firms is typically swapped from fixed-rate back into floating-rate payments, triggering receiving in swaps, which causes swap spreads to narrow.

An increase in demand to pay fixed rates and receive floating forces swap spreads wider, provided Treasury yields are stable.

Corporations that issue bonds also use the swaps market to hedge against changes in interest rates that may result in increased debt service costs.

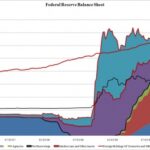

E giova anche ricordare il deficit pubblico USA a questo punto :

Today’s total: $12,607,140,000,000.

We started March at $12,383,717,000,000.We started the fiscal year (October 1) at $11,853,434,000,000.

We have added $223 billion of debt in the last three weeks, and $755 billion in just 5 months.As a reminder, the debt limit is $14.3 trillion.

We are $1.7 trillion away from the limit.At March’s run-rate of about $300 billion per month, the debt ceiling will be breached by October 2010.

If somehow the government manages to reduce the monthly issuance to “just” $200 billion, we have eight and a half months until breach, or January 2011

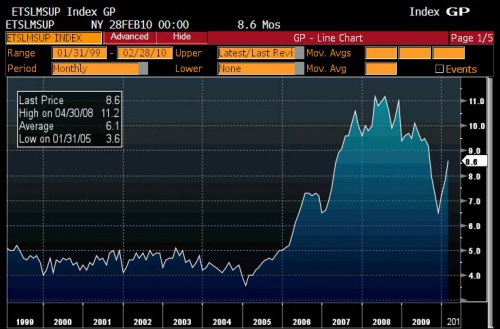

Insomma, credo che ci sia poco da aggiungere, come sul fatto che un double dip del mercato immobiliare – già segnalato più volte in questo blog, è inevitabile :

Existing home sales e Monthly inventor, parlano da soli :

After hitting a nearly 6.6 million in existing home sales in late 2009, the number has now plunged to 5.02 million, a decline of 0.9% sequentially, and a major drop from the artificially induced peak.

Sales for single-family homes were down and were up for condos and co-ops, indicating a preference for smaller, cheaper units among a population concerned with record unemployment and expiring homebuyer taxes.

The number came on top of expectations of 4.98 million, with the range being from 4.75 million to 5.2 million units.

Sales in the Northeast and Midwast improved slightly, even as sales in the South and recently bubble West declined.

Yet the biggest stunner was the months of supply on market which jumped by a 20 year high, from 7.8 months to 8.6 months.

Sempre riguardo gli USA, da segnalare che la Google’s saga continua, il governo cinese è intenzionato a bloccare completamente tutti i servizi offerti dalla società :

Users of Google Inc.’s search engines across Beijing reported erratic service on Wednesday, with the site sometimes failing to open, and some searches for even non-sensitive terms like “hello” returning error messages.

There were problems across several of Google’s search engines, users said, not just the Google.com.hk site to which it has been directing traffic since shuttering its mainland Chinese-language Google.cn late on Monday.

However, other users reported no disruption to their access, or said they were able to search Google successfully minutes after initial searches returned an error messages.

Businesses, university students and people in private homes also reported intermittent problems on the main Google.com site, the Google.co.uk site and Google.ca

Google naturalmente ieri ha sofferto, perdendo la MM a 50gg.

Ed è comico leggere i comunicati provenienti dal governo cinese, sembra di essere tornati per certi versi ai toni utilizzati al tempo della guerra fredda fra URSS e USA :

China’s latest blast at the world’s biggest Internet search company came in the overseas edition of the People’s Daily, the chief newspaper of China’s ruling Communist Party.”For Chinese people, Google is not god, and even if it puts on a full-on show about politics and values, it is still not god,” said a front-page commentary in the paper.

“In fact, Google is not a virgin when it comes to values. Its cooperation and collusion with the U.S. intelligence and security agencies is well-known,” said the newspaper.”All this makes one wonder. Thinking about the United States’ big efforts in recent years to engage in Internet war, perhaps this could be an exploratory pre-dawn battle,” the commentary said of Google’s pull-out.

The overseas edition of the newspaper is a small-circulation offshoot of the main domestic edition, and often makes bolder comments than the main edition.The commentary said Google’s actions should prompt China to focus more on developing its own technology.

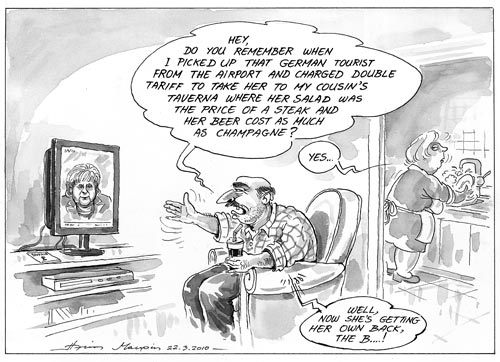

In Europa, invece, si discute sempre animosamente sulla questione greca, ieri ad un certo punto ha iniziato a spargersi la notizia che il FMI interverrà nel bailout.

L’unico risultato apprezzabile per ora è stato che la Swiss Bank ha rinunciato a difendere la propria valuta contro € :

“By repeating the standard line that the SNB will continue to counter excessive gains, he has implied that the current level is acceptable,” said Elsa Lignos, a foreign-exchange strategist at Royal Bank of Canada Europe Ltd. in London.

“He could have gone further and said they are concerned about current” euro-franc levels.Hildebrand, making his first public speech since taking the helm of the central bank, said that the SNB has a “broad arsenal” to counter any excessive gains in the franc if needed.

“The instruments are clear,” he said. “We’re purchasing foreign currencies and we’re able to do that to a very large extent to counter any excessive appreciation.”

E nel frattempo i più disastrati stati sovrani europei (Spagna, Portogallo) stanno decidendo di emettere Bond in $, non è chiaro in effetti il motivo in questo momento, che sia come nel 1974 quando gli USA decidettero di salvare l’Italia ?

Altri tempi, certo – la paura del comunismo allora era fortissima – ma è sempre interessante riportare e conoscere documenti che all’epoca erano segreti.

Questo è un stralcio di una conversazione – data 16 giugno 1974 – fra Kissinger e Burns (allora a capo della Fed) :

Kissinger : I called you yesterday about the possible assistance to Italy if that becomes necessary and I understand that one idea is to use the swap line and that you are a little reluctant to do it.

I don’t want to get into fiscal details which I don’t fully understand.

I just want to point out from a foreign policy point of view we cannot let Italy go down the drain. Whether that is the way to do it or some other way, I don’t know.

Burns: I agree and I have been actively trying to get other countries to contribute a package but what we can do through the swaplines is very limited. The amount could be large but it is a three month loan and that is not what they need.

K. Yes. My people tell me you would not approve more than $300 million.

B. As a start.

K. Yes. Look, on financial things I am not somebody – I cannot get into a debate on numbers. All I wanted to stress to you is to really give this – if it arises – very high priority.

B. I agree and I was active in getting the credit line extended. Also in a meeting with the finance ministers I went around and pushed the Germans and Japanese to contribute to a package for Italy. It is a loan of medium term duration and the swap line does not serve that purpose. That is the essential point.

K. If you can five any other thought to that problem I would appreciate it.

B. You bet I will.[…]

Che la Fed – via FMI – stia allo stesso modo trattando il salvataggio della Grecia ?

Si spiegherebbero allora molte cose.