Aprile 26, 2010 EcoAnemia

Avvistato Titanic a babordo

Chiusura di settimana all’insegna dell’ottimismo, nonostante l’imminente conclusione (entro due settimane ?) della saga greca :

The minister said the German government had been surprised by today’s decision to activate the aid mechanism.

In a telephone call with the Greek Finance Minister he had tried to convince him to still wait a couple of days, Schaeuble explained.The minister announced that he will meet with the leaders of the German parliamentary groups on Monday morning.

Schaeuble repeated that German loans to Greece will come from the state-owned KfW bank. The loans will be then guaranteed by the German government.

Schaeuble said he aimed to seek approval for the guarantees in parliament and hoped to convince the opposition that it will agree to a fast-track law procedure.Earlier on Friday, Germany’s main opposition party, the center-left SPD, said it was willing to support the government in an eventual financial aid for Greece if it informs parliament quickly and gives it enough time to deliberate.

Ed i pareri che il fallimento sia cosa buona e giusta iniziano a diffondersi anche fra gli istituzionali :

Templeton Chairman said Greece should be allowed to go bankrupt as that would be the best way to sort out its finances.

“If we pour piles of cash into a country where corruption extends to top government officials, we won’t see any reforms,”

Nel frattempo, tutti gli indici sono andati in forte rialzo, in attesa probabilmente del sell the news.

Interessante guardare ad esempio il comportamento del Gold :

Infatti, come ho scritto prima, per la prima volta la Grecia avrebbe (il condizionale è sempre d’obbligo) chiesto aiuto al FMI ed all’UE :

The German government reaffirmed Friday that an activation of the aid program for Greece requires an IMF consolidation

program, and that Eurozone heads of state and government must approve the request.

The German government reaffirmed Friday that an activation of the aid program for Greece requires an IMF consolidation program, and that Eurozone heads of state and government must approve the request.

“Eurozone members have said they will provide up to E30 billion in bilateral loans for Greece this year in a joint program with the IMF. Germany’s share would amount to up to E8.4 billion.

German Finance Minister Wolfgang Schaeuble said on Wednesday that most experts estimated the likely IMF contribution at between E10 billion and E15 billion.

Naturalmente, il contagio non si è fatto attendere :

The biggest daily movers in CDS land are now not some irrelevant Greek banks which the world has now given up on, but Portuguese Caixa Geral de Depositos, S.A. (+32 bps, 12%), Belgian Fortis NV (+8 bps, 11%) and Spanish Banco de Sabadell SA (+20 bps, 8%) and Banco Pastor SA (+23 bps, 7%). But. But. GDP is only 2% of GDP? (more like -5% when EuroStat is done with them)

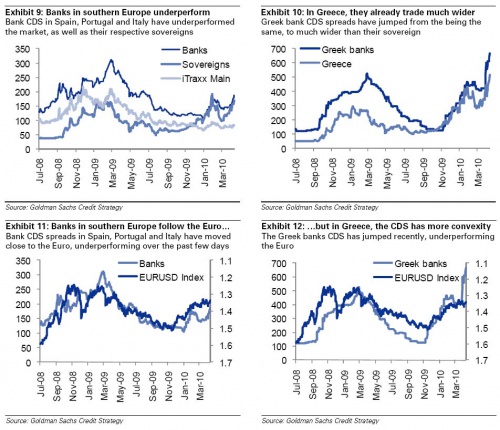

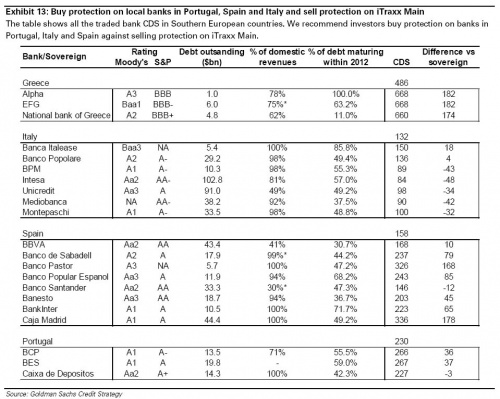

Eh, sì, anche perchè Goldman Sachs sta iniziando a diffondere le solite voci terroristiche, consigliando ai suoi clienti migliori di vendere allo scoperto le banche dei PIIGS :

High unemployment, decreasing house prices and poor to capital markets are likely to continue to challenge firms in southern Europe, where corporate bonds are only around 7% of GDP (compared to 14% in the rest of Europe and 28% in the US).

Local banks, which used to rely on a stable deposit base, will face increased competition from larger players, who are willing to diversify away from bond funding.

They will also face new regulatory charges over the coming months. While we remain positive on financials as a whole, we think the local southern European banks will continue to underperform.

For these reasons, we re-iterate our recommendation to buy protection on local banks in Portugal, Spain and Italy

Eh, sì, riecco Goldman che dà il meglio di sè.

Ed ecco la lista dei titoli consigliati al ribasso da GS :

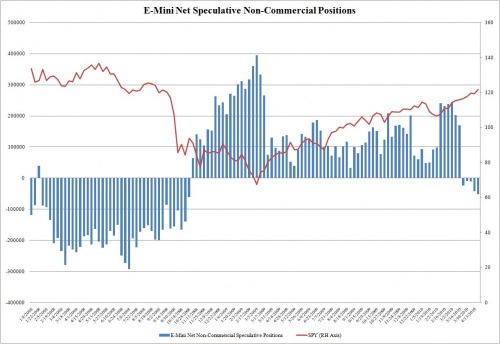

Nel frattempo, le posizioni al ribasso sui mercati USA raggiungono il minimo dai tempi di Lehman (tempo per una correzione arrivato ? Forse) :

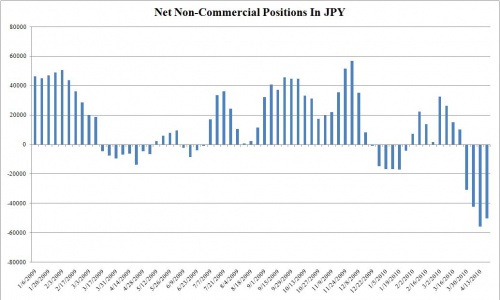

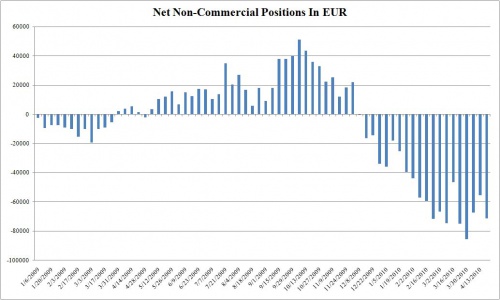

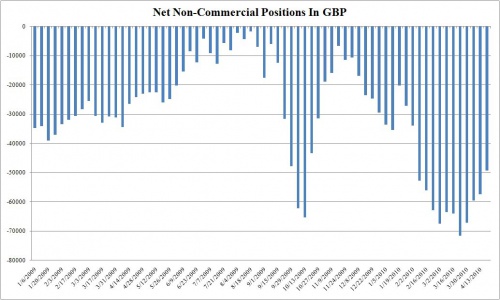

Mentre i movimenti sulle valute ci dicono che solamente lo Yen cala di poco il suo short interest, mentre EUR, GBP e CHF rimangono vicini ai massimi :

Bene, non ci resta che aspettare, anche se un antipasto questa mattina lo abbiamo già visto : € giù, Bonds greci al 9% circa subito in apertura, indici istericamente in rialzo all’apertura.

Ed i politici greci che fanno nel frattempo ?

Il gioco delle tre carte con la loro gente.

ADEDY, the Athens-based federation representing the more than 500,000 Greek civil servants who have seen wages cut this year, said the move signaled a new and “barbaric attack,” and called a protest rally for April 27 [yep, another day of strikes and rioting].

Another demonstration has been set by the opposition Syriza party for today in Athens.

“This is a premeditated crime against Greek society,” Alexis Tsipras, the head of Syriza said in an e-mailed statement.

“The majority of the Greek people are being tossed helplessly in the tempest of insecurity, unemployment and poverty.” He called for a referendum on the decision to seek IMF support.”

Tutto vero e le proteste sono da un certo punto di vista sacrosante, peccato che Papandreou lo abbiano appena eletto proprio loro, ognuno ha i politici che si merita :

Papandreou, who announced today he will trigger the rescue is under fire from voters and unions for raising taxes and cutting wages to reduce a budget deficit that is more than four times bigger than European Union rules allow.

Greeks fear the EU and IMF package, crafted to stem the country’s soaring borrowing costs, will mean lower pensions and benefits, more wage cuts and produce a deeper recession.

The premier won elections in October promising to raise wages of public workers and step up stimulus spending.

Within weeks of coming to power, the new administration discovered they faced a 2009 budget deficit of 12.7 percent of gross domestic product, more than twice the shortfall the defeated New Democracy government had revealed. EU officials revised the deficit further to 13.6 percent of GDP yesterday.

The shortfall derailed Papandreou’s spending plans and forced him to raise taxes and cut wages to try to make good on a pledge to cut the shortfall to 8.7 percent this year. Investors shunned Greek bonds leaving the government struggling to finance its debt.

Papandreou’s popularity has declined, particularly among the public workers who suffered the pay cuts and are the traditional base of his socialist part.

Questo è un vero incompetente che ha fatto di tutto per portare il Titanic contro l’iceberg, rimanendo a sentire l’orchestrina che suonava e continuando a ballare fino alla fine :

Activating the rescue mechanism and turning over economic policy to EU and IMF oversight is “a new Odyssey for Greece,” Papandreou said.

“But we know the road to Ithaca and have charted the waters,” he said, referring to the return of mythological hero Ulysses to his island home after a decade.

Notte, e c’è ancora chi lo difende.