Dicembre 8, 2009 EcoAnemia

Comunicazione mediatica da interpretare

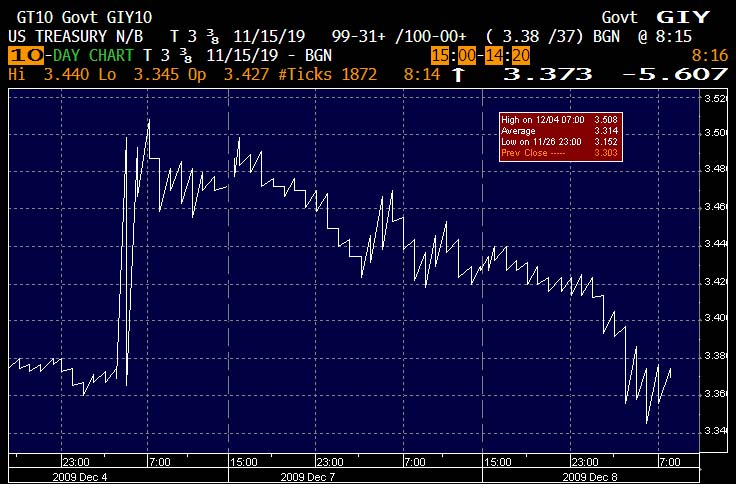

Mentre qualcuno ancora si chiede – forse – come mai i numeri del BLS erano “così” buoni (ma le vicende degli ultimi giorni credo abbiano fatto luce sul perchè) i T-Bonds sono tornati velocemente al livello di venerdì scorso.

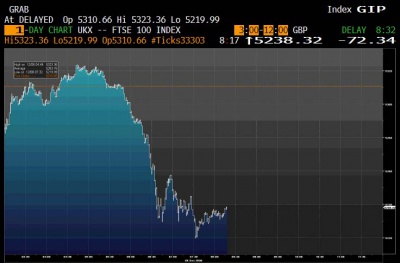

Le novità dal Dubai non sono certo buone per altro, ecco il FTSE inglese :

La ragione ?

Beh,insomma, robetta :

[…]Dubai shares tumbled to the lowest level in almost five months, led by Emaar Properties PJSC and Emirates NBD PJSC, on concern that Dubai World is struggling to restructure its debt.

Emaar, the United Arab Emirates’ biggest real-estate developer, slumped 7.6 percent and Emirates NBD, the region’s largest publicly traded bank by assets, retreated to the lowest since Sept. 3.

The DFM General Index plunged 4.7 percent, the biggest fluctuation among global benchmarks tracked by Bloomberg, to 1,663.35 at 10:41 a.m. in the emirate.

The measure, which is heading for the lowest close since July 13, has tumbled 20 percent since Dubai said on Nov. 25 that it was seeking a “standstill” agreement on Dubai World’s debt.[…]

In un prossimo post ci sarà un ulteriore approfondimento sul Dubaigate.

Nel frattempo mentre la Borsa Messicana veniva momentaneamente sospesa per un non meglio precisato “Administrative Recess”…

![]()

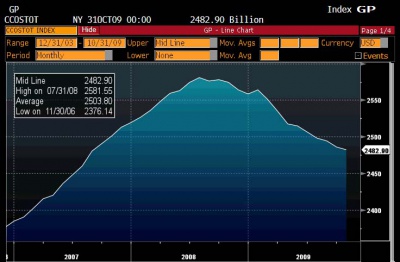

Il credito al consumo si contraeva per il nono mese consecutivo :

[…]Consumer credit decreased at an annual rate of 3-1/4 percent in the third quarter of 2009.

Revolving credit decreased at an annual rate of 7-1/4 percent, and nonrevolving credit decreased at an annual rate of 1 percent. In October, consumer credit decreased at an annual rate of 1-3/4 percent.

Total borrowings declined by 3.5 billion to a total of $2,482.9 billion, with revolving credit declining by $6.9 billion while non-revolving increased by $3.5 billion. […]

[…]As non-revolving credit is directly linked to auto purchases, the seasonal spike in this segment is not surprising as consumers rushed to get financing for all those CfC subsidized Toyotas (and to a lesser extent, domestic cars).

Notable is that the LTV increased to a skyhigh 93%, while the average amount financed has hit a record of $32.3k, a jump of over 6% MoM.

The expected total decline was $9.4 billion, with economists likely ignoring the consumer need to finance even much cheaper auto purchases.[…]

Il mercato dell’auto è destinato a contrarsi ancora di più, il credito non revolving è direttamente collegato agli acquisti nel settore automobilistico.

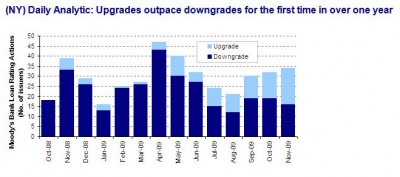

E cosa dice Moody’s ?

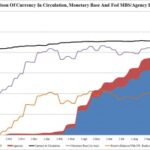

Il grafico è eloquente, altro segnale che siamo al top, mica è importante disquisire sui numeri del NFS propinatici dal BLS, che avevano una funzione ben precisa proprio ad essere mostrati in questo modo.

A lezione di comunicazione mediatica e di analisi tecnica.