Maggio 25, 2012 MacroEcoAnemia

Crisis in a nutshell

Bubas Weidmann : ECB has taken ‘considerable risks’ with measures (don’t you know ?)

Riksbank Dep Gov Jansson : Public finances ‘catastrophic‘ in many European countries, but global economy still looks healthy (lol, a funny news)

German Gfk Consumer Sentiment Indicator June steady at 5.7, up from 5.7 in May (prev 5.6).

Slightly better than Reuters median forecast of 5.6 (at this moment Germans are interested in sun, pizza&mandolino)French consumer confidence rose to 90 in May from an upwardly revised 89 in April (prev 88).

Slightly better than median forecast of 89 (thanks to Hollande)German FinMin spokesman : No problem if next Greek aid tranche delayed beyond end of June (of course no problem for Germany)

Portuguese opposition socialists stand by bailout commitments – opposition leader

Belgian ForMin Reynders: Greece can’t handle further spending cuts and “technical staff” studying Greek exit costs, even if Greek exit “not being considered” (contradictory statements, sure)

More Reydners : No organized discussion at European level about what to do if Greece leaves euro, would be “serious professional error” if central banks and businesses don’t prepare for Greek euro exit (another very encouraging statement)

Norges Bank Governor : International growth outlook significantly weakened, Oil is stronger engine for Norway than ever (and our pump prices are the highest in Europe)

Spain Makes Some Changes To Improve Competitiveness : Licensing Will Be Faster And Easier

Deutsche Bank : Greece is a failed state, can’t blame Greeks for transferring money out of the country (Germans are for cheap Euro)

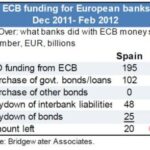

Deutsche’s Fitschen : Figures to revive Spanish banks are staggering, potential Greek bank run could be contagious (and today is a sunny day here, tomorrow is Saturday and next May 27 is Sunday)

Reuters: Spain’s Catalonia Region Needs Government Help; Running Out of Debt Financing (I don’t think this is a real news, they prefer to ask for independence rather than a help from Madrid)

But have no fear, here is the man of providence : Van Rompuy.

EU will do everything to stabilize the banking situation

Confident Greek people will make the right choiceContingency plan for Greece not a priority ; priority is that Greece stays in the Euro

EU considering different scenarios for Greece

Eur/Usd : next target 1.248

Market Indicators : South

Eurobonds : not at all and not only Germany, but even the Netherlands (Dutch PM: Forget Germany; we’ll never allow Eurobonds).

This is the crisis in a nutshell.