Aprile 9, 2010 EcoAnemia

Danger zone ? Macchè (almeno per ora)

Ripresa a gonfie vele per il settore retailer US ?

Ad una lettura superficiale è così, e quindi ecco perchè – soprattutto perchè trainati dagli utili delle multinazionali sicuramente in salita per il Q2 – i mercati abortiscono ogni tentativo di correzione .

Poco da aggiungere sul fronte tecnico, le strategie di trend-following continuano ad impazzare ed a dominare.

Ma proviamo ad allontanarci dalla realtà virtuale degli indici azionari, ed analizziamo quanto successo ieri.

Pimco – la maggiore autorità mondiale sui Bonds – ha paragonato ieri la Grecia nientepopodimeno che al Titanic :

I don’t think that [7%] would be an attractive enough yield.

Greece is sort of like the Titanic.Eighteen things went wrong, and when they go wrong at once it’s problematic.” Of course, with this kind of rhetoric the 10 Year will be trading at 8% tomorrow, followed up by Clarida saying not even 9% would be attractive, and so forth.

When you have the world’s largest bond fund say it is not touching Greece with a ten foot pole essentially no matter what the yield, you get an idea of why Greek 1 Year CDS is trading 600/700.

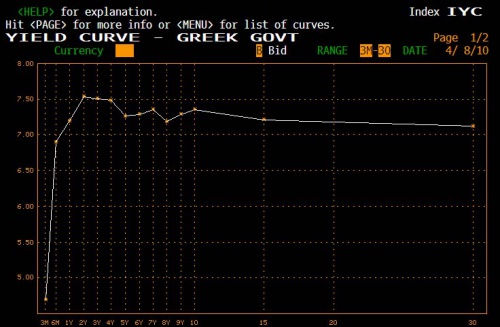

No comment, hanno ragione da vendere, guardate un po’ la yield curve che ci dice.

E lo spread con il Bund è arrivato alla iperbolica cifra di 447 Bps :

Panic in Greece as total freefall envelops both the bond and the stock market.

The 10 Year is now at an absolute record 447 bps spread to bund, or in the mid 7’s in absolute terms.

The stock market has tumbled by about 5% and Greek CDS have surged to a record.

Già Atene -5%, ma nessuno sembra essersene accorto, vista l’euforia di questa mattina in Europa.

Mentre S&P minaccia l’ennesimo inutile downgrade :

Greece is at risk of a rating downgrade if high borrowing costs persist and the government does not manage to address the consequent deviation from its deficit-cutting programme, a Standard and Poor’s analyst said.

Ed a quanto pare, le misure di austerità presentate dal governo greco NON sono sufficienti :

” Shockingly, the department of health insurance for the self-employed has already disbursed almost 50% of the allotted funds in just the first two months of 2010

Treasury’s latest expenditure projections for Greece suggest that most likely there will be a need for further spending cuts.

Three ministries have already disboursed more funds than they should in the first two months of the year : The Ministry of Economy, Competitiveness and the Marine spent 18.2% of its total appropriation for this year, the Interior Ministry 17.4% and the Ministry of Labour 17%.

Even worse are insurances. OAEE health insurance for self employed has disbursed 41.7% of its assets. The social insurance ΙΚΑ 25.3% and 20.4% NAT.[…]

Ma il governo greco si preoccupa non di salvare il salvabile, ma di proibire le vendite allo scoperto sui Bonds locali, cioè l’ultima cosa cui dovrebbero pensare in questo momento :

“Due to massive debit position in HDAT transactions, the Committee of Primary Dealers Supervision and Control decided as of today and until further notice to automatically proceed to repo auctions, at the end of HDAT trading day, in order to cover all transactions with such debit positions,” the statement obtained by Reuters said.

Traders said the decision meant that any uncovered short positions on Greek government bonds would have to be covered, regardless of the price, at the end of the settlement day in the repo auction.

This would make it more difficult to short Greek bonds but might end up affecting market makers more than others, according to some traders.

Year-over-year, trading volume rose 35.9 percent in February. Daily average turnover in February fell to 0.99 billion euros from 1.1 billion in January.

Greece’s borrowing costs have surged as markets worried about the country’s soaring deficit, its debt load and its ability to rollover debt.

Già detto più volte, proprio le ricoperture da short-covering garantirebbero boccate di ossigeno ad uno stato defunto, in questo modo il processo di deterioramento strutturale verrà addirittura velocizzato, dato che, come ha detto infatti Pimco, gli speculatori aspetteranno che siano raggiunti valori da fallimento prima di entrare lunghi sui Bonds greci.

E mentre Goldman Sachs è lapidaria :

“Could Turn Into The Endgame”

Qualche grossa istituzione USA (Goldman stessa ? Morgan Stanley che ieri è improvvisamente schizzata verso l’alto ?) sta accelerando il processo di default ?

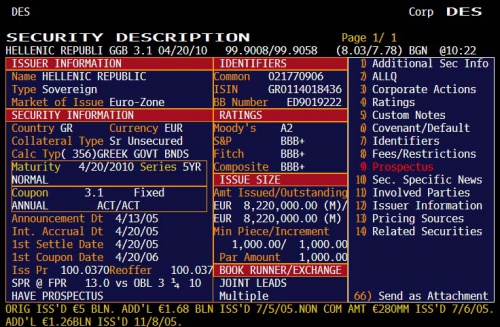

Guardate un po’ infatti :

A large US bank, has been dumping, in what it classified as “panic selling”, its holdings of a 10 Year GGB maturing on April 20, 2010, or in 11 days.

What is unclear is whether the bank has been trading for its own account or for a client.

What is clear, is that the seller is certainly not too convinced that the bond will see a repayment of principalwhen it matures, in other words believes that Greece will go bankrupt before April 20th.

Ma soprattutto, il significato di questa operazione è il seguente :

It is clear that this move is panic.The seller believes that in the next 11 days Greece will go bankrupt, there will be default or anything else to sell a bond expires in 11 days.

Who sold under a sign is a large U.S. bank.

The only thing that has not been established is sold on behalf of a client or on their own behalf?Both are negative developments

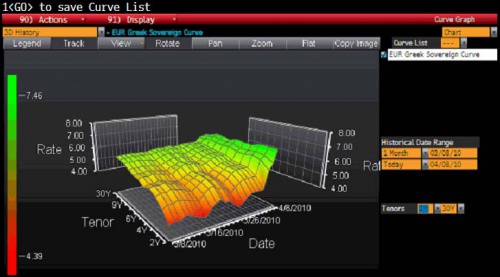

Ed una visione tridimensionale della situazione, è la seguente :

Per chi non masticasse nulla o quasi di grafici tridimensionali, ecco la spiegazione :

The chart from Bloomberg shows the shift in the GGB curve from steep to inverted over the past month.

As we have long claimed, an inverted curve is the death knell for any company, let along a country.

No comment, naturalmente.

L’unico dubbio che al momento ho è sul finale interno al paese : guerra civile contro le istituzioni a causa delle misure di austerità, oppure guerra civile per una situazione che ricorda quelle dell’Argentina e del Sudamerica anni ’80 (= confisca dei fondi da parte delle banche – quindi dello stato e confisca dell’oro fisico), con difficoltà a fare semplicemente la spesa per i generi alimentari di prima necessità ?

Nel frattempo altri focolai si stanno pericolosamente accendendo qua e là nel mondo, ecco un paio di esempi :

Una cartolina dal Kyrgyzstan.

Medvedev also confirmed that Russia would be sending troops to Kyrgyzstan to protect Russians there.

Ed una dalla Thailandia :

Police and soldiers fired water cannon and tear gas in a failed attempt to disperse thousands of protesters who climbed over rolls of barbed wire and forced open the gate of the compound, defying an emergency decree and upping the ante in their broader push for fresh elections

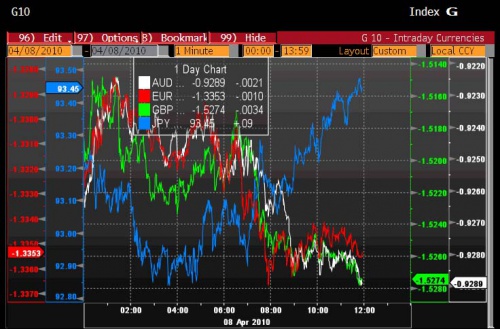

Ma i mercati inesorabilmente continuano a salire, seguendo le logiche del carry-trade contro yen :