Febbraio 24, 2010 EcoAnemia

Double dip recession oramai sicura

L’evidenza sta iniziando a farsi strada ormai, al di là della propaganda, ed i debolissimi dati macro che si stanno susseguendo negli ultimi giorni stanno semplicemente confermando la visione che ho da tempo : double dip recession.

E non solo l’ottimismo degli imprenditori europei sta scemando (ieri IFO in forte calo rispetto alle attese), ma soprattutto i dati americani iniziano a divenire molto più attinenti alla realtà :

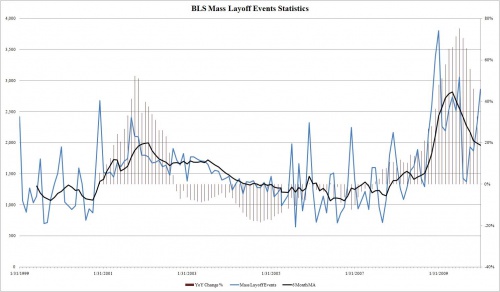

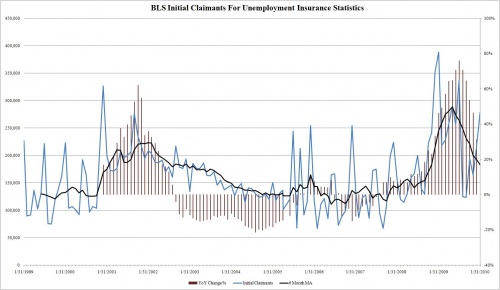

Licenziamenti nel mese di Gennaio ancora di nuovo in forte aumento.

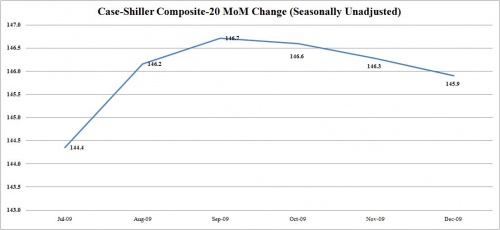

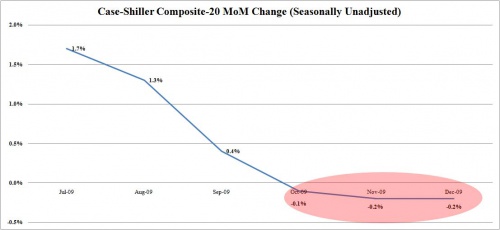

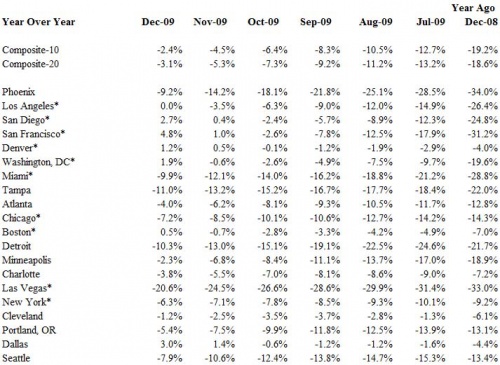

Indice Case-Shiller di nuovo negativo, confermando il double-dip nell’immobiliare.

Ed indice ABC Consumer confidence Index ai minimi del 2010 :

[…]The index is based on Americans’ ratings of the national economy, their personal finances and the buying climate.

As has been true since early 2008, the current economy gets the most negative assessment of the three : Only 8 percent rate it positively, 30 points below the long-term average and in single digits for 13 weeks straight.

Just 24 percent call it a good time to spend money, 13 points worse than the long-term average.

And 43 percent rate their personal finances positively, 14 points below its long-term average.

Half or more have rated their own finances negatively for 88 of the last 94 weeks.[…]

Per altro, anche le statistiche governative iniziano a mostrare la sfiducia dell’ americano medio nei confronti di una ripresa della economia a breve :

[….]The Conference Board Consumer Confidence Index®, which had increased in January, declined sharply in February. The Index now stands at 46.0 (1985=100), down from 56.5 in January.

The Present Situation Index decreased to 19.4 from 25.2. The Expectations Index declined to 63.8 from 77.3 last month.[….]

E, fatto ancora più importante, questo è il valore minimo dal Febbraio 1983.

Numeri davvero orrendi tutti questi, e naturalmente il loro impatto sugli indici non si è fatto attendere :

E mentre la situazione della FDIC continua a farsi sempre più preoccupante :

[…]The U.S. banking industry continued to struggle in the fourth quarter, as the number of banks on the brink of failure continued to rise and the government’s fund to protect deposits fell sharply into the red.

The Federal Deposit Insurance Corp. said Tuesday that its deposit-insurance fund fell to $20.9 billion at the end of 2009, a $12.6 billion drop in the final three months of the year, as bank failures continued at a pace not seen since the savings and loan crisis.

The fund’s reserve ratio was -0.39% at the end of the quarter, the lowest on record for the combined bank and thrift fund. […]

Il numero di istituti di credito USA che presentano domanda di chapter 11 continua a non diminuire, anche se oramai nessuno o quasi menziona questo fatto nei mass media tradizionali.

E quindi, puntualmente o quasi, arrivano i downgrade sull’Europa e sulle banche greche in particolare da parte della solita Moody’s, che sappiamo avere un ruolo non indifferente nella vicenda :

[…]Fitch Ratings has today downgraded the Long-term and Short-term Issuer Default Ratings (IDR) of Greece’s four largest banks, National Bank of Greece (NBG), Alpha Bank (Alpha), Efg Eurobank Ergasias (Eurobank) and Piraeus Bank (Piraeus) to ‘BBB’ from ‘BBB+’ and ‘F3’ from ‘F2′ respectively.

The Outlook on the Long-term IDRs is Negative.At the same time, the agency has downgraded the banks’ Individual Ratings to ‘C’ from ‘B/C’, whilst the ratings of the banks’ senior, subordinated and hybrid capital instruments have all been downgraded by one notch. The Support Ratings and Support Rating Floors (SRF) of all four banks have been affirmed.

A full rating breakdown is provided at the end of this comment. Separately, Fitch has also affirmed Agricultural Bank of Greece’s (ATEbank) Long-term IDR at ‘BBB-‘, which is on its SRF, and Short-term IDR at ‘F3’.

The Outlook on the Long-term IDR is Negative. ATEbank’s IDRs, Support Rating and SRF are based on sovereign support as the bank is majority-owned by the Greek state (rated ‘BBB+’/Negative Outlook).[….]

Diciamo che è un intervento certamente interessato e che arriva – guardacaso – nel momento peggiore della crisi greca.