Settembre 26, 2008 EcoAnemia

E intanto WaMu se ne va

[…]JPMorgan Chase & Co. became the biggest U.S. bank by deposits, acquiring Washington Mutual Inc.’s branch network for $1.9 billion after the thrift was seized in the largest U.S. bank failure in history.[…]

[….]WaMu in March rejected a takeover offer from JPMorgan Chief Executive Officer Jamie Dimon that the savings and loan valued at $4 a share.[….]

[…]WaMu collapsed as its credit rating was slashed to junk and its stock price tumbled. Facing $19 billion of losses on soured mortgage loans, the lender put itself up for sale last week.

WaMu fired CEO Kerry Killinger on Sept. 8 and replaced him with Alan Fishman, who was awarded a $7.5 million signing bonus and $1 million salary[…]

[…]WaMu had about 2,300 branches and $182 billion of customer deposits at the end of June. Its $310 billion of assets dwarf those of Continental Illinois National Bank and Trust, previously the largest failed bank, which had $40 billion ($83 billion in 2008 dollars) when it was taken over in 1984[…]

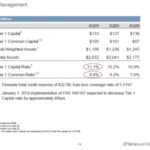

[…]JPMorgan will add branches in California, Washington and Florida, among other states, and will have 5,400 offices with about $900 billion in deposits, the most of any U.S. bank. The branches and credit cards will carry the Chase brand and will be integrated by 2010, JPMorgan said.[…]

Fonte : Bloomberg.com

Il mercato ha fatto il suo corso, ed anche Washington Mutual se n’è andata.

Washington Mutual dispone di oltre 2.200 agenzie, 43.000 dipendenti, per complessivi asset di circa 307 miliardi con 188 miliardi di depositi.

Un grosso affare per JPMorgan&Chase, adesso la più grande banca americana.