Giugno 8, 2010 EcoAnemia

Europe’s stress is “probably” exaggerated

Poco da aggiungere in una giornata che si è svolta secondo copione, prima con le “solite” dichiarazioni – questa volta dall’Austria, che i problemi non esistono, nessun pericolo di contagio :

The Austrian finance minister has said there is “no danger to Europe from Hungary’s debt problems.”

Ma le dichiarazioni del FMI, per bocca di Strauss-Kahn, sono assai ambigue :

Europe’s stress is “probably” exaggerated.

Probabilmente, rotfl.

Nessuna novità quindi nel vedere questo :

€ che continua a perdere terreno, ma c’è alternativa ?

Direi di no, anche perchè ora inizia ad essere il nostro turno, come riporta Market News :

“Italy’s contribution to the EU’s Greece aid package is E14.736 billion out of a total E110 billion package from the EU and IMF, under the three-year economic and financial policy program.

This year’s contribution is estimated to be around E5.4 billion.

The first tranche of this loan E2.921 billion was paid in early May.” Alas, unlike in the US where every new trillion in bond issuance somehow results in a 50 bps tightening in the 10 year, Italy is not quite so lucky. The result of this announcement: new all time high for Italy 10 year Bund spreads at 173 bps.

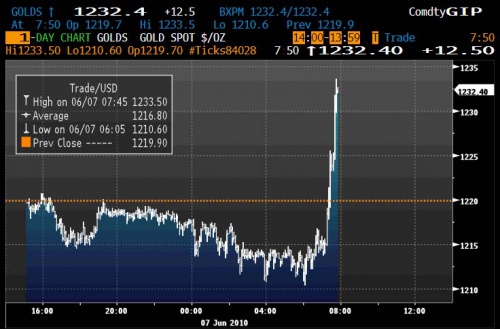

Nel frattempo, Gold alle stelle, nuova spike che lo avvicina di nuovo ai massimi relativi assoluti :

E Spoore che ha il solito comportamento, su nel pre-market e giù nella sessione normale, anche perchè gli istituzionali stanno rollando le loro posizioni sull’ES alla scadenza di Settembre :

Quindi non c’è da attendersi nulla di positivo nelle prossime settimane.

Mentre la mistress GS ci informa che il nuovo target annuale per l’€/$ è a 1.164, come ci ricorda Zerohedge :

No doubt sentiment is now very negative and short positions which had been aggressively pared back will have started to rebuild with various downside strategies being implemented.

Whilst it is a little concerning that sentiment has swung so uniformly negative again it is hard to argue with the underlying logic and the apparent official European comfort with the level of the euro adds to the reasons to play from the short side; they may become uneasy should the FX move become disorderly or accelerate but a weak euro offers more benefits than problems for them at the moment.

So whilst the uniformity of view is concerning, the risks for now still feel weighted to the downside. We are holding a core short position and hoping short squeezes provide the opportunity to sell more close to 1.2000 and above.

A stop needs to be left above the 1.2110/50 area which offered multiple lows before breaking. First support emerges at the Asian low of 1.1876 , with 1.1800 likely to attract interest, while a reasonable target is the 2006 cycle low of 1.1640.

Mah, se GS ci dice questo, i minimi sono molto, molto più in basso.