Maggio 20, 2010 EcoAnemia

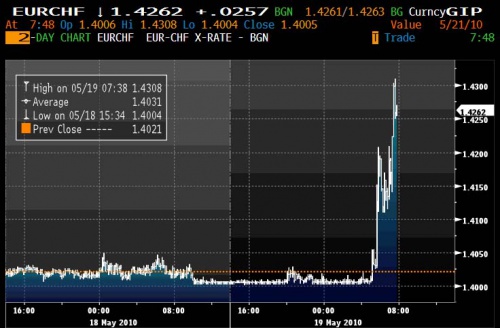

Folle spike sull’EUR/CHF

L’intervento di ieri della SNB non è certo stato casuale, anzi,ma è figlio della mancanza di fiducia da parte delle principali istituzioni nei confronti dell’€ (e di riflesso anche della £ e pure del $) : oggi il Telegraph riporta la notizia della fuga immediata di capitali (9.5 bilioni di €) dalla Germania alla Svizzera.

Ed ecco i punti salienti dell’articolo di Ambrose Evans-Pritchard :

The market is left asking what skeletons are lurking in the cupboard,” said Marc Ostwald from Monument Securities.The short ban follows a report by RBC Capital Markets that circulated widely in the City accusing German banks of failing to come clean on 75pc of their €45bn exposure to Greek debt.

German lenders have the lowest risk-weighted capital ratios in the world after Japan.

They were slow to rebuild safety cushions after the sub-prime crisis, and now face a second set of losses on Club Med holdings. Reporting rules have let Landesbanken delay write-downs, turning them into Europe’s “zombie” banks.

Even so, nothing adds up in this BaFin episode.

Germany acted alone, prompting a tart rebuke from French finance minister Christine Lagarde.”It seems to me that one should at least seek the advice of the other member states concerned by this measure,” she said.Brussels was not notified.

The deep rift between Berlin and Paris has been exposed again, leaving it painfully clear the European Montary Union still lacks the fiscal and governing machinery of a viable currency union.

Far from stabilising markets, BaFin’s move set off a nasty sell-off in credit markets. Markit’s iTraxx Crossover index – measuring risk in mid-level corporate bonds – jumped 57 basis points to 586.

Markit said BaFin had caused liquidity to dry up in “febrile conditions”. The Libor-OIS spread watched for signs of strain in interbank lending widened further

If the purpose of BaFin’s action was to drive wolfpack “speculators” off Greece’s back, it failed. Yields on 10-year Greek bonds rose 37 basis points to 7.918pc.What it showed is that CDS contracts barely matter.

The issue is whether “real money” investors such as the Chinese central bank are willing to buy Greek and Portuguese debt.

Ma soprattutto :

The short ban set off instant capital flight to Switzerland. BNP Paribas said €9.5bn flowed into Swiss franc deposits in a matter of hours on Wednesday morning.

The Swiss central bank intervened to hold down the franc.

This caused the euro to shoot back up against the US dollar after an early plunge.

The euro had already bounced off “make-or-break” technical support t $1.2135, the 50pc “retracement” of its entire rise since 2000, but any rally is likely to be short-lived.

In effetti, un movimento del genere è pauroso solo a pensarlo – figuriamoci a vederlo – e dà il segno di quanto la situazione intermarket sia davvero pessima per l’€ in questo momento, tale da mettere davvero molto dubbi sulla sua sopravvivenza nel lungo periodo, e getta molti dubbi pure sullo stato di salute della “locomotiva” tedesca.

E le ragioni del comportamento tedesco sono anche e soprattutto problemi di politica interna per la Merkel, dato che per rimanere in piedi deve piegarsi ai voleri di una opposizione che cavalca l’Euroscetticismo più marcato :

Zerohedge riporta infatti il seguente commento di Hans Redecker, currency chief per BNP :

“As a German citizen, I wish to apologise for the stupidity of my government,” said Hans Redeker, currency chief at BNP Paribas.

He said the CDS ban deprives reserve managers of a crucial hedging tool for non-securitised loans and will scare away global investors needed to soak up Club Med bonds.

“The European market is likely to become utterly dysfunctional. Just as the market showed signs of stabilisation with real money starting to buy euros, the Germans have destroyed this glimmer of hope,” said Mr Redeker.

“The BaFin ban is a desperate political move by a government battling for survival. Angela Merkel needs the support of the Left so she has given in to a witch-hunt against banks and speculators.”

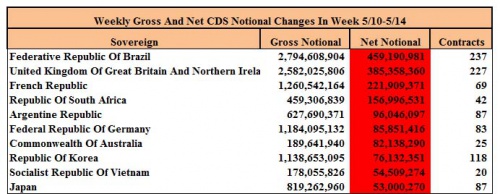

Ed infatti, coerentemente il mercato dei CDS continua a non sottovalutare la situazione di UK, Francia e Germania, che nella scorsa settimana sono di nuovo tornate ai primi posti della speciale classifica dei top derisker :

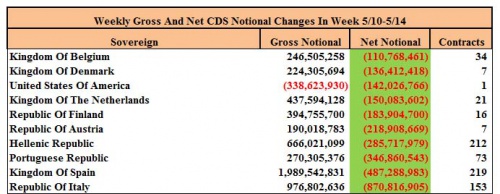

Mentre fra i top rerisker ci sono – al solito – gli stati sovrani che nelle settimane scorse sono stati oggetto di speculazioni varie, con in testa Grecia ,Spagna,Portogallo ed Italia :

Nel frattempo, anche i dati macroeconomici globali iniziano a peggiorare sempre di più.

Ecco il dato sul deflatore del PIL che ha fornito il Giappone questa notte :

Anche in questo caso, significativo il commento di Zerohedge :

Japan just announced its annualized Q1 GDP, which came in at 4.9%, well below the survey consensus of 5.5%.

Yet while the country’s subpar economic performance was not too surprising, the deflator came in at a massive -3%, indicating that in the second decade after the country first set off to prove that Keynesianism works when public debt is somewhere north of 100% it still have to find success.

Ancora una volta la trappola della liquidità di Keynesiana memoria pare avere colpito ancora.