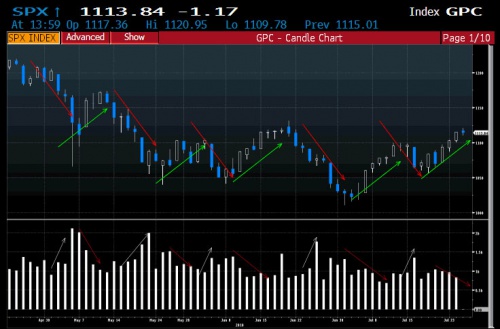

Luglio 28, 2010 EcoAnemia

Grafici della settimana e considerazioni tecniche

Non occorre aggiungere in effetti nulla, questi sono i mercati del 2010, che salgono con volumi infinitesimi e calano con alti volumi (sempre in aumento, per altro).

Il recupero prima ed il cambio di trend ora dell’€/$ fanno inoltre pensare che il QE 2.0 sia alle porte od addirittura sia già segretamente in atto da almeno un paio di mesi (non abbiamo naturalmente prove di questo fatto, ma il sospetto ce l’ho da tempo a dire il vero).

Ed il principale motivo del rally dei listini è il sentiment troppo negativo.

Quello che invece è certo è il deterioramento della economia :

Consumer Confidence Drops Again – At 50.4, Below Expectations, And From An Upward Revised 54.3

Scetticismo sulla ripresa sempre più in aumento, poco da dire.

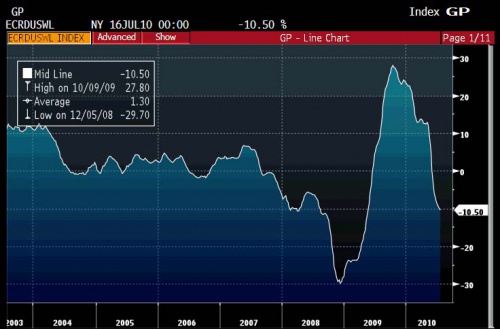

ECRI Leading Indicator Breaches Critical -10 Threshold, Hits -10.5

C’erano dei dubbi a riguardo ?

Anche se il mercato immobiliare dà piccoli cenni di risveglio :

June new home sales come in at 330,000 on expectations of 310,000

Case-Shiller home price index +0.5% in May (mom, +4.6% yoy) vs. median forecast +0.2%

Ho volutamente tralasciato nei giorni scorsi il commento sullo stress test delle banche europee perchè di buffonata trattasi, sia nella sostanza, che nei termini .

Mostrerò solo alcuni spotlight :

Standard & Poor’s Ratings Services revised its outlook on the Republic of Hungary to negative from stable. At the same time, we affirmed the long- and short-term ‘BBB-/A-3’ foreign and local currency sovereign credit ratings. The transfer and convertibility assessment on Hungary remains at ‘A-‘.

5 Spanish Cajas will fail (ooohhhh) including CajaSur, Caixa Catalunya, and Caja-Duero

Hypo Fails, All Other German, Portuguese, French Banks Pass Test

Ed ecco le barzellette :

Banks will only be tested for sovereign debt exposure just on trading books, not on debt held to maturity .

The 91 banks being stress-tested were only examined on European sovereign debt losses for the bonds they trade, rather than those they hold to maturity, according to a draft European Central Bank document.“The haircuts are applied to the trading book portfolios only, as no default assumption was considered,” according to a confidential document dated July 22 and titled “EU Stress Test Exercise: Key Messages on Methodological Issues.” The tests will assume a loss of 23.1 percent on Greek debt, 14 percent of Portuguese bonds, 12.3 percent on Spanish debt, and 4.7 percent on German state debt, according to the document obtained by Bloomberg News.U.K. government bonds will be subject to a 10 percent haircut, and France 5.9 percent. The tests assume the weighted average yield on euro-area five-year government bonds will rise to 4.6 percent in 2011 from 2.7 percent at the end of 2009.

The massive “A Whale” oil skimmer has effectively been beached after it proved inefficient in sucking up oil from the Gulf of Mexico spill.The oil is too dispersed to take advantage of the converted Taiwanese supertanker’s enormous capacity, said Bob Grantham, a spokesman for shipowner TMT.

He said BP’s use of chemical dispersants prevented A Whale, billed as the world’s largest skimmer, from collecting a “significant amount” of oil during a week of testing that ended Friday.”When dispersants are used in high volume virtually from the point that oil leaves the well, it presents real challenges for high-volume skimming,” Grantham said in a written statement that did not include oil-collection figures from the test.

No comment.