Agosto 21, 2008 EcoAnemia

Il collasso annunciato di Fannie Mae

U.S. Treasury Secretary Henry Paulson’s “bazooka” may be intimidating the same investors he intended to reassure.

The powers Paulson won from Congress last month enabling a government rescue of Freddie Mac and Fannie Mae — authority he likened to a weapon whose mere existence made it unlikely it would have to be fired — may end up making a bailout more likely, say analysts and investors.

They say the threat of government action is creating uncertainty that is raising the companies’ borrowing costs and increasing the odds Fannie and Freddie will need taxpayer funding. […]

[…]”The common shareholders will probably be completely wiped out” Paul Miller, an analyst at FBR Capital Markets, said in a Bloomberg Television interview.

“Preferred will also see a lot of pain. But that is up in the air because a lot of banks own the preferred. You put a lot of banks in trouble if you just wipe out the preferred also.” […]

[…]Paulson’s intention to not use the authority hinges on the ability of the companies to sell debt to finance their portfolios of mortgages and asset-backed bonds.

The companies have $223 billion of bonds due by the end of the quarter, according to data compiled by Bloomberg.

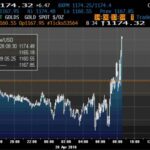

Fonte : Bloomberg

Ok, abbiamo capito.

Ecco il collasso annunciato : Fannie Mae, istituzione finanziaria con 800 miliardi di $$ nel bilancio, non 8 o 80, 800 miliardi, il 5% dell PIL USA.

Oggi o domani (od al massimo nel week-end) verrà nazionalizzata o salvata in qualche modo azzerando gli azionisti (in stile Bear Stearns) : salvata solo per chi ne detiene il debito (quindi solo per gli obbligazionisti).

Secondo Pimco basteranno 40 miliardi di $ sotto forma di azioni addizionali preferred (quelle detenute in maggioranza dalle istituzioni finanziarie più importanti, come riporta appunto Bloomberg).

Il collasso di una mega istituzione come Fannie Mae potrebbe essere il segnale di un minimo per il medio periodo (Parmalat, Enron, LTCM), ma in questo momento siamo ancora lontani dai minimi relativi toccati in Luglio.

Staremo a vedere.