Febbraio 9, 2010 EcoAnemia

Il dado è tratto

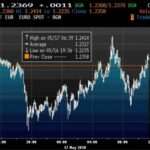

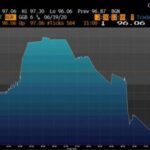

[…]Development Minister and deputy secretary general of the PSOE, José Blanco, said yesterday that the sharp drop in the Spanish stock market last week was due to “attack” of financial speculators, who were “somewhat murky maneuvers” to punish the euro and weaker economies in the euro.

But who are these ‘speculators’ evil to which he referred to the minister of development ?

What are their names ?

How much money managed ?For the trading desks of major international brokers have sounded in recent sessions Brevan Howard,

Moore Capital and Paulson & Co, among others, Hegde funds that manage more than 500,000 million and are among the top ten.

The total figure is nearly double industry.

“There have been specific macro hedge funds, which are taking positions against the euro and against the CDS (insurance coverage of non-payment) of Spain,” said a broker from abroad that term around 7% of the daily volume of the Spanish stock exchange.

“When these guys are short against someone, there is nothing to do.

Already suffer from investment banks in late 2008 when institutions like Merrill Lynch and Morgan Stanley saw their CDS exceeded the benchmark of 2,000 points.

Among others who have been short are the hedge funds at Goldman Sachs and JP Morgan, according to financial sources say.[….]

Ed infatti, puntualissimi come un orologio :

[…]Goldman cuts Greek and Italian banks to sell

National Bank of Greece and Greek Postal Savings Bank were cut from neutral to sell on Tuesday at Goldman Sachs, which also cut Italian banks Banca Monte dei Paschi di Siena, Banco Popolare and Credito Emiliano from neutral to sell.

Goldman said there are now elevated levels of sovereign risk and that will hit bank returns, specifically via higher and diverging cost of equity, mark-to-market impact on bond portfolios, upward pressure on financing costs and downward pressure on volume growth and returns.A bank that is big and diversified will hold up better, said Goldman.

Its view on Spanish banks is unchanged with a buy rating on Banco Santander, and sell ratings on domestic banks.[…]

Ed i signori americani vengono a farci la morale a noi europei, a partire dall’imbelle abbronzato, parlando di etica, finanza, nuove regole.

Ripeto, ribasso pilotatissimo dalle solite mani forti che – quando lo decideranno – ribalteranno in quattro e quattr’otto la situazione.

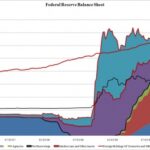

Gli USA sono davvero messi male.