Febbraio 19, 2010 EcoAnemia

+.25%, ora il gioco si fa duro

[…]The Federal Reserve Board on Thursday announced that in light of continued improvement in financial market conditions it had unanimously approved several modifications to the terms of its discount window lending programs.

Like the closure of a number of extraordinary credit programs earlier this month, these changes are intended as a further normalization of the Federal Reserve’s lending facilities.

The modifications are not expected to lead to tighter financial conditions for households and businesses and do not signal any change in the outlook for the economy or for monetary policy, which remains about as it was at the January meeting of the Federal Open Market Committee (FOMC).

At that meeting, the Committee left its target range for the federal funds rate at 0 to 1/4 percent and said it anticipates that economic conditions are likely to warrant exceptionally low levels of the federal funds rate for an extended period.

The changes to the discount window facilities include Board approval of requests by the boards of directors of the 12 Federal Reserve Banks to increase the primary credit rate (generally referred to as the discount rate) from 1/2 percent to 3/4 percent.

This action is effective on February 19.In addition, the Board announced that, effective on March 18, the typical maximum maturity for primary credit loans will be shortened to overnight.

Primary credit is provided by Reserve Banks on a fully secured basis to depository institutions that are in generally sound condition as a backup source of funds.

Finally, the Board announced that it had raised the minimum bid rate for the Term Auction Facility (TAF) by 1/4 percentage point to 1/2 percent. The final TAF auction will be on March 8, 2010.

Easing the terms of primary credit was one of the Federal Reserve’s first responses to the financial crisis.On August 17, 2007, the Federal Reserve reduced the spread of the primary credit rate over the FOMC’s target for the federal funds rate to 1/2 percentage point, from 1 percentage point, and lengthened the typical maximum maturity from overnight to 30 days.On December 12, 2007, the Federal Reserve created the TAF to further improve the access of depository institutions to term funding.

On March 16, 2008, the Federal Reserve lowered the spread of the primary credit rate over the target federal funds rate to 1/4 percentage point and extended the maximum maturity of primary credit loans to 90 days.

Subsequently, in response to improving conditions in wholesale funding markets, on June 25, 2009, the Federal Reserve initiated a gradual reduction in TAF auction sizes.

As announced on November 17, 2009, and implemented on January 14, 2010, the Federal Reserve began the process of normalizing the terms on primary credit by reducing the typical maximum maturity to 28 days.

The increase in the discount rate announced Thursday widens the spread between the primary credit rate and the top of the FOMC’s 0 to 1/4 percent target range for the federal funds rate to 1/2 percentage point.

The increase in the spread and reduction in maximum maturity will encourage depository institutions to rely on private funding markets for short-term credit and to use the Federal Reserve’s primary credit facility only as a backup source of funds.

The Federal Reserve will assess over time whether further increases in the spread are appropriate in view of experience with the 1/2 percentage point spread.[…]

Questo è il comunicato della Fed di ieri sera intorno alle 22.30 ora italiana, in cui ha annunciato a sorpresa – il giorno prima delle scadenze tecniche di Febbraio – l’aumento del costo del denaro dello 0.25%.

La reazione del mercato non si è fatta attendere , immediatamente sono stati rilasciati circa 2 milioni di pezzi sullo SPY per la cronaca all’annucio :

Curioso il fatto che in seduta si sia raggiunta l’area di resistenza 1100/1107 da me segnalata più volte, e sia stata raggiunta nei giorni precedenti con volumi netti negativi.

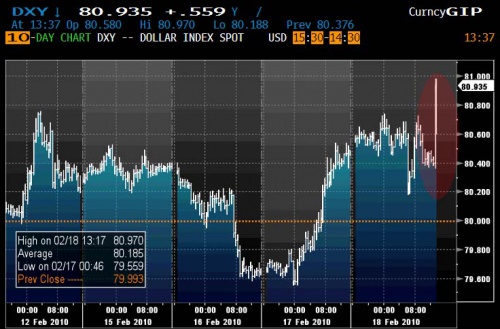

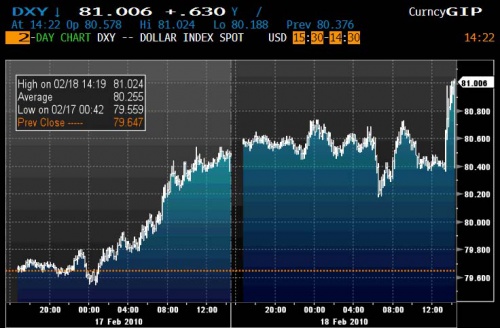

DXY che naturalmente subito si impenna ed €/$ che immediatamente finisce sotto 1.35 in un battito di ciglia.

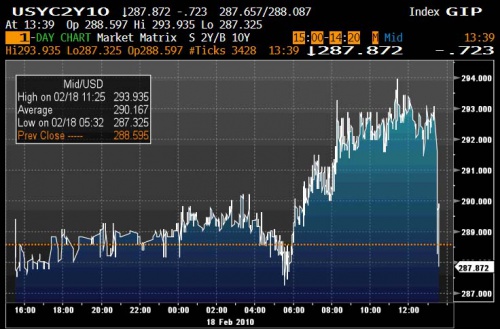

Reddito fisso che naturalmente cede vistosamente.

Bene, ora le carte sono state scoperte, vedremo che succede nei prossimi giorni, che si preannunciano molto volatili.

Scordatevi però crolli dei mercati, questo poco ma sicuro.