Febbraio 8, 2010 EcoAnemia

La storia si ripete : Grecia 2010 come Italia 1992

[…] a large U.S. investment bank (which has benefited from the bailout of U.S. banks) and two very large hedge funds would behind the attacks against Greece, Portugal and Spain.

Their goal ?

Earn much money by creating a panic that allows them to demand of Greece interest rates ever higher while speculating on the CDS market, a market completely unregulated and opaque, so there also sell more than they have purchased.

Why not mention the names?

Simply because he is a bundle of presumptions that a court may not be sufficient in a court case.And in the words of one market operator: “we do not play with these people.” […]

[…]the two hedge funds that hold most of the Greek market of CDS were furious at having received only 2% of the last Greek loan (launched January 25, for a period of 5 years, it has collected 25 billion request for 8 billion last survey).As they gained a lot of CDS, they needed to secure their gains (in cases of falling rates of those CDS), put in front of the paper, that is to say government bonds (so – loses a CDS, and we won on the loan and vice versa).

Because they have a big problem for now, they can not sell the CDS if they would themselves fall classes. To show their strike force, and further push up CDS, they attack on Greece in creating panic, “the CDS, is a bottomless pit with 200 million dollars, you play as if you had a billion dollars, “said one market analyst.

Same game for the U.S. investment bank, which hopes eventually to lend money directly to Greece became unable to borrow on the markets.

Once the country to its knees, it will see the government to offer him a loan at a rate obviously prohibitive […]

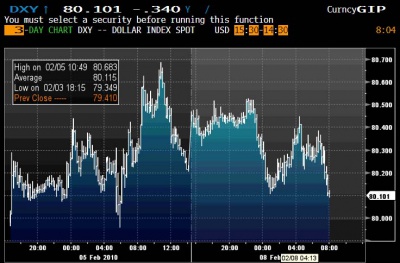

[…]To increase the panic, these hedge funds and U.S. investment bank began to sell arms to turn the euro, followed by investors stunned.If the euro lower, does not mean that the eurozone will burst ?

What justifies the required interest rates still highest in Greece, Portugal and Spain …

Yesterday, the euro has almost reached $ 1.36 in less than two weeks, he lost dime, fifteen cents for two months.A slide that corresponds to nothing, but that side effect, provides air to the EU economy: over the euro lower, more products made in eurozone become attractive. “A very good news in this mess,” quipped one analyst. […]

[…]It is also necessary that the Union expresses its total solidarity with the countries attacked. This is no time to recall the Maastricht Treaty, which prohibits it comes to the aid of a State member of the eurozone.If investors have the absolute guarantee that Greece will not sink, the dust settles. Germany, until very reluctant to say that solidarity begins to understand that the euro is now in danger[…]

Fonte : Zerohedge

Molto, molto interessante, io credo di avere compreso anche di chi si tratta, visto che questo è il loro modo di agire, probabilmente in combutta con le medesime autorità greche.

Chi detiene da mesi infatti la più larga posizione in $ contro € ?

Chi agisce sempre in questo modo , attaccando prima la moneta e poi il paese ?

Chi si definisce un filantropo e poi agisce sempre e comunque in questo modo mettendo in ginocchio intere economie ed interi paesi ?

Nei tre paesi attaccati in questo momento (Greece, Spain, Portugal), che coalizioni politiche sono al governo, e di che orientamento ?

A voi la risposta.

Hint : Italy, 1992, ci sono i medesimi personaggi e le medesime banche d’affari coinvolti in questo sporco gioco.

P.S.: CVD, please rileggere tutti i post sull’argomento dei mesi scorsi.