Marzo 9, 2010 EcoAnemia

Le bugie hanno le gambe corte

Il referendum islandese sulla legge Icesave (= rimborso ai risparmiatori inglesi ed olandesi sul crack delle banche islandesi) ha dato un risultato ovvio, direi lapalissiano :

93% Of Icelanders Reject “Icesave” Bill In Historic Referendum

La legge, per altro, era passata davvero a fatica nel parlamento locale :

The Icesave deal passed through parliament with a 33 to 30 vote majority.

Grimsson blocked it after receiving a petition from a quarter of the population urging him to do so.The government has said it’s determined any new deal must have broader political backing to avoid meeting a similar fate.

Per altro, perchè mai il già provato popolo islandese avrebbe dovuto prendersi carico delle leggerezze e degli errori compiuti da tutti coloro che avevano investito in prodotti di cui non conoscevano nè il loro funzionamento, nè i rischi cui potevano incorrere :

“Ordinary people, farmers and fishermen, taxpayers, doctors, nurses, teachers, are being asked to shoulder through their taxes a burden that was created by irresponsible greedy bankers,” said President Olafur R. Grimsson, whose rejection of the bill resulted in the plebiscite

Occorre sempre sapere valutare le grandi occasioni irripetibili che vengono ogni giorno presentate nella jungla delle offerte dalle fregature.

Ecco ad esempio uno spot pubblicitario di ieri :

[…]California bonds finance investments in our schools, roads, housing, parks, levees, public facilities and other crucial infrastructure projects.

They also finance the research and development of stem cell therapies to treat and cure diseases which ravage lives and families.

The bulk of these bonds will help finance infrastructure projects. California voters have approved the issuance of more than $65 billion of bonds to improve and build new schools, roads, housing, parks and levees.

Over the next few years, the State will be selling these bonds to raise the money to build these projects.

By investing in these bonds, you will help turn the projects you approved at the polls into reality – adding to our quality of life and the vibrancy of our economy.

On this website, you will learn more about California bonds and notes, and about how to become an investor. Please visit us again soon. This site will be updated regularly to feature upcoming bond sales, with information specific to the types of bonds being offered.

E soprattutto :

Individual investors enjoy advantages when they buy bonds or notes during the early order period

Mi raccomando, accorrete numerosi e sottoscrivete subito bonds californiani, soprattutto a lunga scadenza, attratti dall’alto rendimento offerto inizialmente.

Poi però fra qualche anno non lamentatevi se andranno in default e perderete tutto o quasi il capitale investito.

Basta solo per altro informarsi, ma si sa, spesso il brand vale molto più di ogni altra considerazione fra la gente comune.

E, mi raccomando, credete sempre alle fregnacce dei politici, qualsiasi schieramento siano ,soprattutto quando parlano della cattiveria degli investitori ribassisti.

Ecco le parole del sempre lucido Jim Rogers sulla vicenda ellenica :

When asked should Europe bail out Greece, Jim says: “No, of course not, they should let Greece go bankrupt. It would be good for the euro, it would be good for Greece, it would be good for everybody.”

No, of course, not, if you think that speculators and hedge funds went out and run up a deficit of 12% of the GDP, of course not.The Greeks did it and the Greek politicans did it.

Then other people see the problems and started selling.The main people who are selling in Greece are Europeans who are selling, cause they see the problems.

It’s just like in America. When Fannie Mae got into trouble, people sold Fannie Mae.

Speculators got in too, as people call then, but speculators did not cause Fannie Mae to run up gigantic debts and get into trouble, management did. And then that attracted investors who tried to take advantage of the situation.

Parole (purtroppo) sante, è la legge di mercato, e giustamente il popolo greco sta rigettando un piano di austerità voluto dalle stesse autorità che hanno causato tutti i problemi.

L’intera intervista la potete ascoltare qua :

Jim Rogers infatti ha ragione da vendere.

Ed infatti, le dichiarazioni dei politici durano sempre lo spazio di qualche ora, e poi sono sempre e comunque smentite dalle autorità finanziarie :

German market regulator BaFin said Monday that so far, it doesn’t see any sign of massive speculation in credit default swaps against Greek government bonds, despite some recent press reports suggesting this.

A significant reason behind widening CDS spreads is the increasing demand for insurance against Greek risk, BaFin said in a statement, adding that it closely watches the government bond and credit derivatives markets for selected euro-zone countries.

Credit default swaps are tradable, over-the-counter derivatives that function like a default insurance contract for debt. If a borrower defaults, the protection buyer is paid compensation by the protection seller.

Swap buyers may be protecting investments they own or simply making bearish bets against companies or countries.

BaFin said data published by the U.S. Depository Trust & Clearing Corporation don’t signal an increase in new open positions and don’t indicate massive speculation.

It is true, however, that the gross volume of outstanding CDS contracts for Greek government bonds amount to around $83 billion as of Feb. 12, according to DTCC, more than twice the $41.1 billion a year earlier.

The gross volume of CDS contracts for Greece, which mirrors the trading turnover, has fallen again in recent days, BaFin said.

The net volume of CDS contracts, meanwhile, is a better indicator for possible speculation, BaFin said, adding that the net volume of outstanding CDS contracts has been largely unchanged at around $9 billion since mid-January, according to DTCC data.

Per cui, non è vero che la crisi greca è causata dalla speculazione degli hedge che mirano ad affossarla tramite i famigerati CDS , ma i CDS salgono di valore perchè gli investitori esteri – soprattutto europei – si stanno rapidamente liberandosi dei Bonds greci.

Infatti :

Volume in cash (greek) bonds has spiked.

Ed anche la Merkel ha dovuto fare un veloce retrofront sull’argomento CDS :

Merkel : cannot ban CDS outright

In verità, la storia sui CDS presenta dei lati oscuri abbastanza interessanti :

Sov CDS traders are demanding collateral in gold.

Ed infatti, ecco come funziona attualmente questo mercato non regolamentato :

You buy CDS on the US, and you tell your counterparty in advance (because, you know practically speaking) this is when the contract determinations are made.Let’s say you wish to transact with JPM, one of the top three CDS traders in the world.

Of course, JPM realizes all too well what this would do to the price of gold should sovereign risk go higher, either naturally, as a function of 400% debt/GDP ratios (including all unfunded liabilities) or, hypothetically, because every “speculator” wants to jump in on the sov trade for whatever reason.

JPM, which is already very much short gold in its prop books, as has been the case with all major banks over the past 50 years, will be very unwilling to execute this transaction, and will tell the other side of the trade to buzz off, and that only €-denominated trades will be accepted

Ecco quindi la spiegazione di tutte le dichiarazioni che girano intorno agli argomenti CDS ed €.

E credo che si capisca anche da queste cose quale sarà il destino del Gold nel lungo periodo..

Uri Dadush nel frattempo ci informa che ora è il momento della Grecia, ma presto le misure di austerity si diffonderanno a macchia d’olio :

“It Is Virtually Inevitable That Greece Will Default Or Need A Bailout”,everyone is undergoing austerity measures (now coming to Portugal, soon Italy, UK, Germany, Japan, and, lastly the, US)

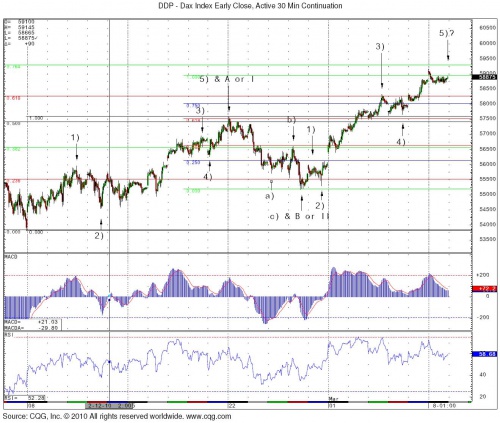

Da un punto di vista puramente tecnico, invece, se il Dax appare stanco e probabilmente ha raggiunto o quasi la sua estensione massima del rimbalzo :

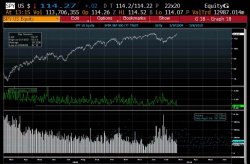

Gli indici USA invece hanno tuttora un buono spazio di salita, almeno fino a 1150 di Spoore :

Anche se tutto il rally di Febbraio – tanto per cambiare – si è svolto con volumi sullo SPY negativi :

Per la cronaca, ieri si è raggiunto il volume minimo dell’anno 2010.

E che la salita – almeno negli USA – non sia ancora finita, anzi – lo si vede anche dall’analisi del Vix :

Che non mostra infatti nessuna configurazione rialzista, almeno per il momento.

Anche se è vero questo fatto :

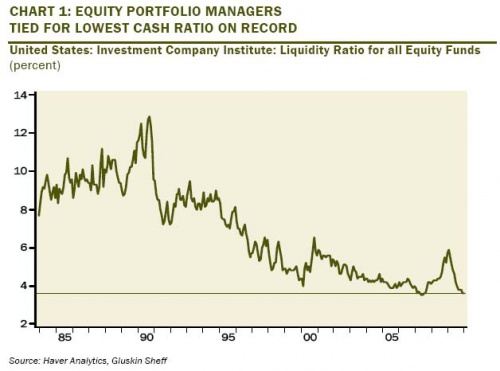

The VIX is at 17; the TED spread at 8bps ; CDS has tightened in to six-week lows; the nasdaq and small cap indices have broken out to new recovery highs; oil is back above $82/bbl … and, as charts below from the ICI illustrates, portfolio managers have been so nervous to miss any up-moves that they have run down their cash holdings to 3.6% of assets from nearly 6% a year ago — the largest decline in 19 years.

Equity cash ratios are back to where they were in September 2007, just as the stock market was hitting its peak.

Ma se è vero che il Nasdaq e le small caps hanno raggiunto i livelli pre-Lehman, gli altri indici USA sono ancora piuttosto lontani.