Settembre 15, 2008 EcoAnemia

Merril passa a Bank of America, Lehman salta (1)

[…]Bank of America Corp. cemented its status as the largest U.S. consumer bank by agreeing to acquire Merrill Lynch & Co., the world’s biggest brokerage firm, for about $50 billion.

The bank will swap 0.8595 shares of its stock, equal to $29 a share based on Friday’s closing price, for each share of New York-based Merrill Lynch, according to a statement from Bank of America today.

The bank pulled out of talks yesterday to acquire Lehman Brothers Holdings Inc., the beleaguered securities firm. The deal is expected to close in the first quarter of 2009 […]

[….]”If Bank of America can put a fence around the bad assets, that retail distribution is a powerhouse. The Merrill Lynch combination makes more sense than a Lehman deal”[…]

[…]The company is the dominant U.S. retail bank, accounting for almost 10 percent of the nation’s bank deposits and about one of every five newly issued home mortgages.

The deal may mark the end of Merrill’s almost century-long history as an independent company.

According to Merrill’s Web site, founder Charles Merrill solidified his reputation by advising clients to sell stocks prior to the crash of 1929. The firm went public in 1971 and in 1974 introduced its corporate logo – a bull that Merrill executives say embodies one of the most recognizable brands in the world-[…]

[…]Merrill still had more than $50 billion of mortgage-linked ” collateralized debt obligations” and their value continued to tumble.

Merrill posted a $9.8 billion loss in the fourth quarter, and Thain had to sell about $12 billion of equity in Merrill to bolster its capital base. At the time, Thain said he thought Merrill’s troubles were mostly behind it[…]

[….]Lewis’ willingness to buy Merrill comes two and a half months after Bank of America completed its $2.5 billion purchase of Countrywide, which was forced to sell due to mounting losses on subprime home loans — the same assets that led to four straight quarterly losses at Merrill Lynch. Subprime loans go to home buyers with the weakest credit, and defaults are running at record rates.[…]

[…]The potential of a Bank of America-Merrill deal is very positive for the market.It’s a stronger balance sheet, and brings more certainty and confidence in the counterparty of trades.” […]

Fonte : Bloomberg

Anche Merrill Lynch è arrivata alla fine della sua storia come società indipendente : è stata infine rilevata da Bank of America che ha messo sul piatto 40 miliardi di $ per la sua acquisizione.

Cambiano gli scenari, spariscono nuovi attori , rilevati da altri, oppure altri falliscono : vedi Lehman, di cui non mi aspettavo a dire il vero questa fine ingloriosa, ma in una situazione in cui si lotta per la sopravvivenza, non mi stupisce che abbiano sacrificato il pesce più piccolo per salvare quelli più grossi (soprattutto AIG).

Adesso il fronte si sposta inevitabilmente in Europa, dato che negli Usa i cadeveri ci sono stati – ed anche molto pesanti – e credo che sul fronte bancario (tolto forse Wachovia) si sia definitivamente risolta la situazione.

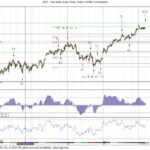

Un’ ultima nota a margine : i singoli grafici non mentono mai, ma proprio mai.

Mentri gli indici possono essere manipolati ad arte, come è capitato negli ultimi giorni della settimana scorsa.

(1 – continua)