Novembre 11, 2009 EcoAnemia

Monolines a rischio bancarotta (ora è tutto più chiaro)

[…]Bond insurer Ambac Financial has warned bankruptcy is a distinct possibility, sending its shares plummeting more than 30% today.[…]MBIA lost $727.8m, or $3.50 per share, during Q309, compared to an $806.5m loss, or $3.42 per share, in Q308.[…]

Bene, bene, ora inizio a capire i veri motivi dell’impennata degli ultimi giorni con volumi ridicoli.

Per chi non sapesse (o non ricordasse) chi sono le due monolines Ambac e MBIA, consiglio di rileggere attentamente l’archivio di questo blog, perchè è proprio la caduta di queste due società specializzate nella riassicurazione del credito AAA (!) che ha fatto partire la slavina l’anno scorso.

Ed occhio ad AIG, come sto continuando a ripetere, qui sta un’altra buona parte del marciume che negli ultimi mesi hanno nascosto sotto il tappeto.

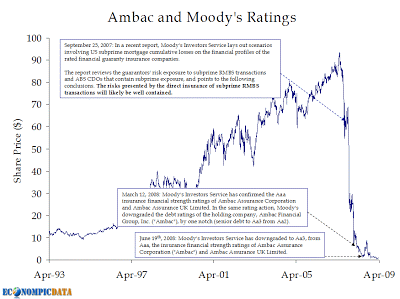

Per chi mastica un po’ di inglese, comunque, ecco un riassunto della telenovela Ambac, che ci preannuncia grosse novità.

Su MBIA si possono trovare più o meno esattamente le stesse cose.

E ricordo che queste due società erano considerate fino all’anno scorso l’investimento ideale per vedove ed orfani.

[…]Rewind to July of last year and Ambac was headed to zero fast after having been downgraded by S&P the month before. Basically, their business model of using a AAA rating to guarantee bonds (a sort of credit default insurance) was rendered non-viable by the credit crunch.[…]

Ma a Novembre, a sorpresa riuscirono a salvarsi all’ultimo momento, raggiugnendo i tempi supplementari :

[…]Ambac said late Wednesday that it commuted, or tore up, roughly $3.5 billion worth of guarantees on complex mortgage-related vehicles known as collateralized debt obligations.

The company’s main bond insurance unit paid counterparties $1 billion in cash to settle the contracts.

The deal will improve the capital position of the bond insurance unit for rating agencies.Later the insurance subsidiary eliminated its dividend to the parent company[…]

Poi ci fu la ridicola finta offerta di takeover da parte di Buffet :

[…]When the company rejected an unsolicited offer by Warren Buffett to reinsure $800 billion in municipal bonds insured by Ambac and MBIA in December, this was generally seen as a sign of strength. But, the company was holding on by a thread.[…]

Altro momento di difficoltà, ed altro possibile bailout in Marzo :

[…]Bond insurer Ambac Financial Group is one that will investigate Treasury’s offer to backstop a market for securities it holds in its investments.

The public-private program will use $75 billion to $100 billion in money from the Troubled Asset Relief Program called TARP to generate $500 billion in purchasing power to buy legacy assets held by investors, with a government backstop encouraging private sector investors to purchase the assets.”

A broad array of investors are expected to participate in the Legacy Loans Program,” the Treasury said in a fact sheet it provided Monday. “The participation of individual investors, pension plans, insurance companies and other long-term investors is particularly encouraged.”[…]

Ed intanto, le agenzie di rating continuavano a downgradare le due monolines :

[…]Ambac did not get TARP money. All the while, the two companies MBIA and Ambac continued to be downgraded by the ratings agencies – dead men walking […]

Ed alla fine il miracolo accadde :

[…]Bond insurer Ambac Financial Group posted net income of $2.2bn, or $7.58 per share, in Q309, compared with a net loss of $2.4bn in the year-ago quarter.Quarterly results were impacted by unrealized mark-to-market gains in the New York City-based financial services and insurance firm’s credit derivatives portfolio and gains from Q309 reinsurance cancellations.

The firm experienced a positive $2.1bn change in fair value of credit derivatives, driven by the adjustment made under Financial Accounting Standard (FAS) 157 relating to Ambac’s widening credit spread…

“We continue to make progress in de-risking the balance sheet via negotiated reinsurance buy-backs, CDO of ABS commutations, settlements related to defaulted RMBS transactions as well as expanded analysis of expected recoveries relating to RMBS representation and warranty breaches“[…]

Ma ora dicono che probabilmente devono fare bancarotta ?

E dove sta il vero problema ?

[…]The muni connection comes from the fact that Ambac was a large guarantor in the municipal bond market.[…]

Sempre e comunque gli MBS.

Sì, loro, quelli che la FED ha riacquistato e che dice di avere terminato o quasi il buy back.

Se li sono presi tutti o quasi, ma ciò non servirà a salvare Ambac, pare :

[…]Forget what you may have read in the newspaper about state budget problems or bond insurer meltdowns. This is a perfect time to be buying municipal bonds.[…]

[…] The default rate on munis is minuscule, especially for GOs, water-and-sewer revenue bonds, and the other plain-vanilla offerings that make up the majority of the muni market. Even triple-B-rated munis – the lowest rung of investment grade – have a default rate of only 0.06%

[…]Over the years, this incongruity has fueled the growth of Ambac (ABK), MBIA (MBI) and other bond insurance companies. By selling states and cities insurance that turns triple-B and single-A bond issues into triple-A’s – reducing government borrowing costs in the process – the bond insurers manage to pocket much of the extra yield that would otherwise go to investors.

Best of all, bond insurers rarely had to pay claims, certainly not on the plain-vanilla GOs and water-and-sewer bonds. “In my opinion,” says Paul Disdier, who oversees the municipal bond fund division at Dreyfus, “the worst thing to happen to the muni market is the spread of bond insurance.”[…]

[…]It’s that risk was being underpriced. That’s why Ambac is hitting the wall.The Fed and the Treasury are on record as being leery of guaranteeing anything in the municipal bond market. So, with Ambac crumbling and no Federal government backstop, there is no safety net for bad investments in munis[…]

Infatti fu proprio l’improvviso allargarsi dello spread, su cui per anni le due monolines avevano costruito il loro business “sicuro ed inaffondabile” che le ha distrutte.

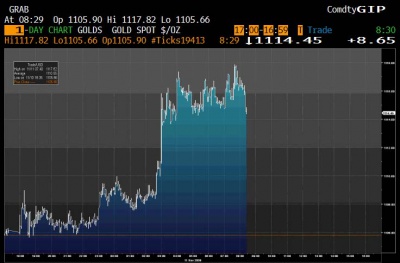

Ed ecco la piramide Exter che torna prepotentemente a mostrarsi.

Sempre più instabile, e se manca l’appoggio degli MBS (anche semplicemente con un “widening” degli spread) la situazione diventa ancora più difficoltosa.

E se l’oro si impenna all’improvviso, appunto, cosa succederà ai venditori di call perpetue che si sono autoalimentati ed autofinanziati in questo modo per anni ed anni ?

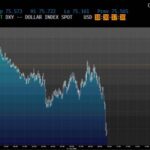

Intanto, ecco la attuale situazione :

No comment.