Giugno 20, 2012 EcoAnemia

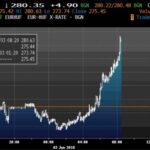

My technical point of view before Ben

Bunds are attractive to short because they are at historical lows in spite of the fact that the German fiscal position can only deteriorate,”said one hedge fund manager of a large top-tier global macro firm.

“It is an obvious trade if you can wait”.

Yesterday more than 50% of fund managers at a conference in Monaco said they expect German bund yields to double within a year.

Obvious reason : bunds could tumble due to Germany taking on additional (perhaps shared) debt or because the situation stabilizes in Europe and there is less demand for safety —->money flowed out of German bunds and into Italian and other periphery debt, rather than out of Europe.

Such a scenario would attract foreign capital to Europe and help boost the euro.

S&P500 currently is contemplating this scenario.

An inverted head-and-shoulders pattern, target at area 1400 .

But today another operation twist ?

Yesterday G20 statement :

We fully support the actions of the Euro Area in moving forward with the completion of the Economic and Monetary Union.

Towards that end, we support the intention to consider concrete steps towards a more integrated financial architecture, encompassing banking supervision, resolution and recapitalization, and deposit insurance.

The adoption of the Fiscal Compact and its ongoing implementation, together with growth-enhancing policies and structural reform and financial stability measures, are important steps towards greater fiscal and economic integration that lead to sustainable borrowing costs.

But the fiscal union of Europe is NOT a done deal now.