Febbraio 22, 2010 EcoAnemia

Ottimismo solo apparente

Nella giornata di venerdì, i principali indici USA sono tornati sopra la media a 50gg, dando un segnale di forza e facendo presagire una possibile continuazione del bull market.

Quello che succederà nei prossimi giorni naturalmente al momento non mi è dato saperlo, ma è interessante notare ad esempio che lo Spoore ha raggiunto area 1100/1110, che è una forte resistenza, già segnalata più volte, ed il destino dei diversi mercati è legato al superamento o meno di questa importantissima quota.

Nel frattempo – nell’indifferenza generale – falliscono altre quattro banche negli USA :

[…]Le autorità statunitensi hanno annunciato quattro nuovi fallimenti bancari. Dall’inizio dell’anno sono già venti le banche che hanno chiuso i battenti negli Stati Uniti.

Tra gli ultimi istituti falliti c’è anche la californiana La Jolla Bank.

Questa alla fine del 2009 disponeva di circa 3,6 miliardi di dollari d’attivo e di 2,8 miliardi di depositi. Le 10 agenzie della Jolla Bank saranno rilevati da OneWest Bank, un’altra banca californiana.

Si tratta del più importante fallimento dall’inizio dell’anno.Le altre banche costrette a depositare il bilancio sono la George Washington Savings Bank (Illinois), la Marco Community Bank (Florida) e la Coste National Bank (Texas).[…]

Fonte : Cdt.ch

E le posizioni ribassiste con l’€ raggiungono un nuovo record storico :

[…]The CFTC just released its February 16 COT detail, which showed that net euro shorts climbed once again, hitting a new record “high” of -59,422.

This is -30.30% of the open interest.

The record net long exposure from May 15, 2007 of +119,538 is a distant memory.

The increasing bearishness on the euro was countered with some profit taking on net long yen positions. Net speculative yen longs declined from +22,396 to +13,912 (11.6 of OI).[…]

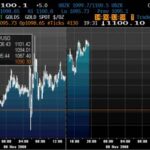

Ed altrettanto nell’indifferenza generale, il Gold – ma in € – raggiunge un altro record storico :

E mentre la vicenda greca da un certo punto di vista sembra diventare una vera e propria soap-opera :

[…] Papanikolaou resigned this week as general director of the Greek Public Debt Management Agency and will be replaced by banker Petros Christodoulou.

His resignation – which comes after concerns over Greece’s public debt fuelled the decade-old euro’s biggest currency crisis – was one reason why the bond was being postponed, he said.

Papanikolaou said it was standard practice in Greece to replace senior civil servants after a change in government.

He has remained in place as the head of the country’s debt agency since the Panhellenic Socialist Movement, Pasok, came to power in October last year.

With Greece needing to raise almost €17 billion to meet bond redemptions in April and May, expectations for a second bond issue remain high.

The country issued €8 billion of five-year paper with a 6.1% coupon late January.That bond was trading at mid swaps plus 380 bps today, some 5 bps wider than yesterday and 30 bps wider from mid swaps plus 350 bps at release, an analyst said. […]

Sì, una soap-opera, perchè – toh, che strano – il nuovo Head Of Greek Debt Office proviene casualmente, indovinate un po’, ma non voglio mica guastarvi la sorpresa :

Petros Christodoulou, born 1960, is the General Manager of Treasury, Global Markets and Private Banking.

Before joining the Bank in 1998, he worked in various positions in Global Markets for Credit Suisse First Boston and for Goldman Sachs.

Additionally, at JPMorgan he led the derivatives desk, followed by the short-term interest-rate trading and emerging markets division in London as Managing Director.[…]

Che coincidenza, un uomo alle dipendenze dei colonizzatori del mondo.

Ma intanto, purtroppo la Grecia sta implodendo anche internamente , e la situazione – già esplosiva – non tarderà a degenerare :

[…] Exports have fallen 18 percent since the beginning of the customs strike as the shipping of goods via maritime, rail and air links is paralyzed, Christina Sakellaridi, president of the Panhellenic Union of Exporters, told private Skai radio today.

Greek motorists lined up at gas stations as fuel stocks dwindled while a strike by customs workers over government austerity measures stretched into a fourth day, hurting imports and exports.

The Federation of Greek Customs Workers called a three-day strike on Feb. 16 and decided yesterday to extend the action by six days to protest government austerity measures aimed at trimming Europe’s biggest budget deficit.

Greece is once again “hostage to strikes by powerful labor union groups,” the National Federation of Greek Commerce said in an e-mailed statement.

The strike is “catastrophic” for the country’s trade and industry as well as shipping, food and transport companies and the Greek consumer, said the Athens- based organization, which represents Greek commerce groups. […]

Solo questione di tempo.