Marzo 30, 2010 EcoAnemia

Riassunto della giornata di ieri

Ieri giornata più di gossip che di veri spunti tecnici, interessante vedere solo il comportamento delle materie prime, che per la prima volta dopo giorni hanno rimbalzato :

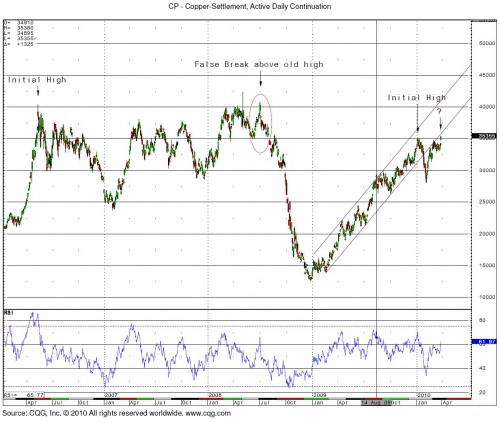

Copper, che ieri ha fatto segnare i massimi dell’anno (e dall’Agosto 2008, per la cronaca).

E Gold, che sta cercando qualche spunto di rilievo in una situazione di consolidamento.

Da segnalare che è attesa nei prossimi mesi una forte domanda da parte della Cina :

[…]The World Gold Council (WGC) believes that gold consumption in China will continue to catch up with the rest of the world following the deregulation of the Chinese gold market in 2001.

Demand from China’s two largest sectors (jewellery and investment) reached a combined total of 423 tonnes in 2009 but domestic mine supply contributed only 314 tonnes during the same year.

This Shortfall creates a “snowball” effect as China’s gold industry may not be able to keep pace with the annual leap in domestic consumption despite rising to be the world’s largest gold producer since 2007[….]

E sempre a proposito di Cina, da segnalare ieri il rimbalzo degli emergenti in generale, e di Shanghai in particolare :

Tutto il resto della giornata si è viavia dipanato fra dati macro e gossip.

S&P che conferma il rating AAA all’UK, ma con outlook negativo :

[…]On March 29, 2010, Standard & Poor’s Ratings Services affirmed its ‘AAA’ long-term and ‘A-1+’ short-term sovereign credit ratings on the United Kingdom (U.K.).

The outlook remains negative.

The Transfer & Convertibility (T&C) assessment for the United Kingdom is ‘AAA'[…]

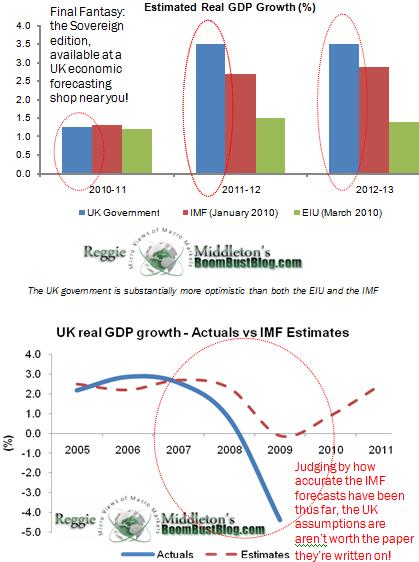

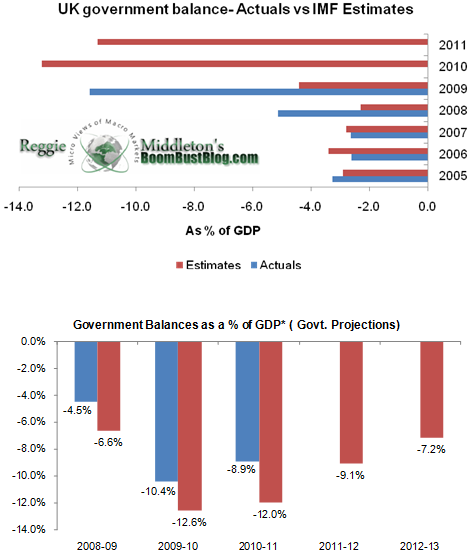

Ma come segnalato già più volte, appaiono troppo ottimistiche le stime fornite dal governo inglese :

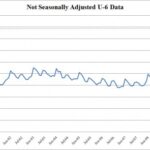

Mentre gli USA non stanno certo meglio riguardo al debito, anzi :

[…]March 29, 2010 Total US Debt Subject To Limit: $12,629,674,000,000.

Total debt at the beginning of March: $12,383,717,000,000

Net debt (includes Trust Funds and marketable debt) issuance month to date: $246 billion

Net Bills issued: $107 billion

Net Notes issued: $138 billion

Net Bonds issued: $13 billion

Debt limit: $14,294,000,000,000.

Debt capacity: $1.665 trillion and dropping. At $220 mBillion per month in net new issuance as projeced by the CBO, this will last the US just under 8 months. […]

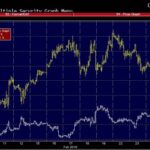

E mentre UBS acquista 3000 S&P “large” (hedgeranno qualche cosa ?) :

[…]Yesterday we discussed the S&P futures capitulation following last week’s record cover in Large S&Ps of over 66,000 contracts.

We just got word that as of 11:20 am CST UBS has purchased another 3,000 S&P LargeCost to them : nearly $1 billion.

On a cash equivalent margin basis, this is about $20 billion in S&P moving power.

As UBS is not quite as, let’s say, connected as GS et al, these are considered to be short covering trades.[…]

Sembra che qualcuno in effetti abbia acquistato nelle ultime settimane :

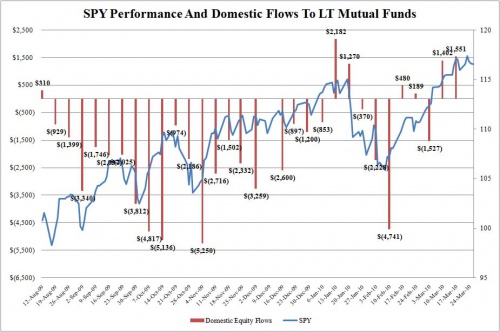

[…]The Investment Company Institute notes that the week of March 17 saw the largest inflows into domestic equity mutual funds since just before the February correction.

At $1.6 billion, the inflow was the second highest in 2010, and only topped by the January 20 number of $2.2 billion.

Yet the year to date number is still negative by a large margin at ($2.6) billion, even as the market has risen by 3% since the beginning of the year[…]

Anche se dall’inizio dell’anno l’inflow è tuttora negativo, nonostante il mercato stia guadagnando circa il 3%.

Staremo a vedere, anche se una correzione pare imminente (e sarebbe pure salutare).