Agosto 2, 2010 EcoAnemia

Riepilogo della settimana

Vediamo un po’ quello che ci ha detto il mercato nell’ultima settimana.

Durable Goods came at -1.0%, a major disappointment to consensus which had been hoping to a nice boost from the previous -1.1% number (now revised to -0.8%), and looking for a +1.0% reading.

Better luck next time. Durables ex transportation came at -0.6% on expectations of 0.4.

New orders of non-defense aircraft plunged by -25.6%, while the ever critical to the global economy Computers and Electronic products, dropped across both shipments (-4.1%) and New Orders (-1.9%).

Eh, sì, ordini durevoli in declino, ma non ci si poteva aspettare diversamente altro.

New Weekly Claims At 457K On Expectations Of 460K

Chicago PMI At 62.3 Versus Expectations Of 56 Print

UMich Consumer Confidence Comes Better Than Expected, At 67.8 On Consensus Of 67

Questi invece sono dati macro migliori del previsto, messi però in ombra dal più importante di tutti, cioè la revisione del GDP :

GDP comes in at a below consensus 2.4%, which a huge drop from the revised Q1 number which came in at 3.7% (from 2.7%). The GDP Price index comes at 1.8%, the core PCE comes at 1.1%, from 0.7% previously.

Ed in Europa ?

All’apparenza sembra che vada tutto bene :

In verità ci sono problemi strutturali – ed alcuni proprio di ordine pubblico – che fanno capolino :

From CNBC: Spain Jobless Rate up to 20.09 Percent

Spain’s unemployment rate rose to a 13-year high of 20.09 percent in the second quarter, the government said Friday, as the job market lagged behind an economy that has barely managed to break out of recession.

Though the rate increased from 20.05 percent in the first three months of the year, the National Statistics Institute (external link) said the number of people working actually increased

As Market News reports :

“The drivers had been on strike for three days through Wednesday, protesting a government effort to open up their profession, which is part of the austerity package agreed by Greece in exchange for up to E100 billion in loans from the Eurozone and the IMF.

About 70% of gas station owners say they have run out of supplies, while shortages of food and other goods have also been reported, affecting tourism at peak season.“

Ed anche nell’intermarket le cose piano piano peggiorano :

Zerohedge ci spiega il perchè :

EUR Libor at 0.83063%, Euribor at almost 0.9%, and top tier European Commercial Paper are now at their worst levels since about a year ago. The stress test came and went, and the market couldn’t care less.

And this is despite the ECB’s latest monetary operation, in which E23.2 billion was allotted in a 3-month long term refinancing operation (LTRO): the intervention failed to prevent the ongoing EUR Libor surge.

It is starting to get very troubling for Europe, where banks, knowing all too well that only the ECB is the INDISCRIMINATE lender of first an last resort, refuse to lend to anyone else as without the primacy example of some other private party taking the first loss risk tranches, there is no incentive to go out and lend

E l’€ ?

In questo momento non può che salire, poichè pompato verso l’alto dalle varie banche centrali, in particolare dalla SNB :

The SNB launched a heavy-duty program of euro buying earlier this year in an effort to hold down the soaring Swiss franc.The bank’s official reserves more than doubled from the end of last year to the end of last month, reaching 226.7 billion Swiss francs by June 30.In May alone, the SNB scooped up the equivalent of almost €60 billion, equal to around 15% of the country’s entire annual economic output.

E’ tempo quindi di andare al ribasso ?

A mio parere assolutamente no :

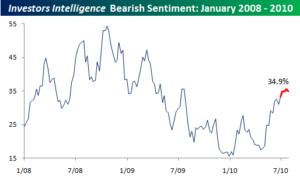

Troppi pessimisti ancora sul mercato.

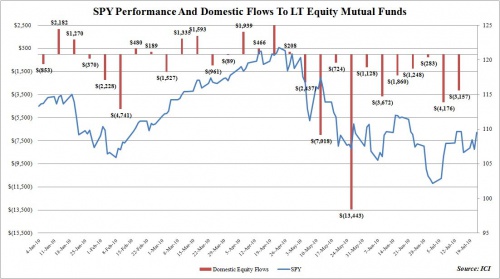

12a settimana di uscita di fondi dal mercato, indi acquista la FED come al solito in questi casi !

Un punto in cui – forse – si potrà tentare uno short nello Spoore ?

Almeno una 50a di punti sopra, al momento gli indici mondiali sono tonici e guidati dagli emergenti :

Fra 1130 e 1150 di Spoore si giocherà la battaglia dei prossimi mesi.