Luglio 13, 2010 EcoAnemia

Sempre più una farsa

AA reports $0.13 EPS versus expectations of $0.11. A month ago EPS expectations for AA were $0.16 per Bloomberg.

Q2 revenue was $5.19 billion on consensus of $5.02 billion.A month ago this number was $5.140 billion. The company projects an increase from 10 to 12% in global aluminum consumption on “improved end-market demand.

Questi sono i numeri della trimestrale di Alcoa.

Interessante notare che le stime – secondo Bloomberg – per l’EPS un mese fa erano 0.17, poi una settimana fa sono improvvisamente calate a 0.14, ieri erano di 0.12 , ed Alcoa poi esce con “significativo e buon risultato” a 0.13.

Giochiamoli al lotto questi numeri, ormai la credibilità dei dati di bilancio non è zero, ma sottozero.

Nel frattempo, ieri British Petroleum +10% sul possibile take-over da parte di Exxon :

U.S. oil major Exxon has sought clearance from Washington DC to examine a takeover bid for BP PLC (BP.LN), according to the Sunday Times.According to oil industry sources, the Obama administration had told Exxon and one other U.S. oil company, thought to be Chevron, that it would not stand in the way of a deal that could value BP at up to GBP100 billion, the newspaper said.

The sources said there was no certainty that Exxon would make a move, but said talks with Washington indicated a renewed interest as BP came closer to plugging their oil well in the Gulf of Mexico.“There have been talks at a high level, and Exxon has expressed a serious interest. It is too early to talk about a bid yet, but they are clearing the way,” a senior oil industry source told the newspaper.

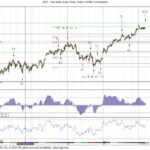

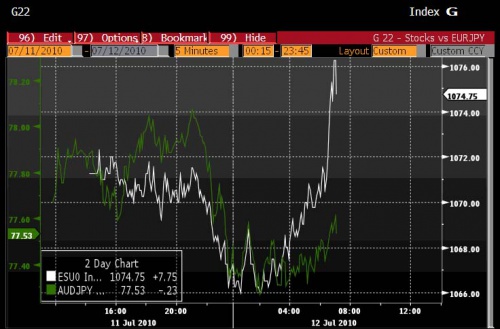

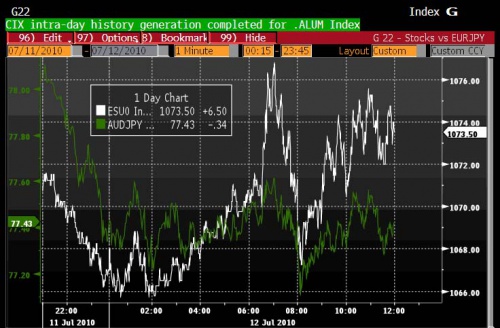

Il rally dello Spoore nel frattempo pare mostrare il fiato corto :

Notare che i volumi non sono minimi, ma proprio non ci sono stati.

Solo carry-trade e decoupling con l’Aud/Yen :

Pronta ancora una volta a scommettere che oggi la forbice si chiuderà in un senso o nell’altro.

S&P conferma il rating AAA all’Inghilterra, pur ammettendo che una revisione al ribasso è alle porte :

- The coalition government has set out what we view as a strong framework for fiscal consolidation in its June 2010 budget.

- We are affirming our ‘AAA’ long-term rating on the United Kingdom reflecting our view of the U.K.’s resources, as evidenced by its wealthy and diversified economy, ample fiscal and monetary policy flexibility, and adaptable product and labor markets.

- However, in our view, a number of large and politically challenging spending decisions are still to be made, and Standard & Poor’s medium-term economic forecasts for the U.K. are less optimistic than the assumptions underlying the budget. We therefore believe there is still a material risk that the U.K.’s net general government debt burden may approach a level incompatible with the ‘AAA’ rating.

- As a consequence, we have maintained the negative outlook on the long-term rating on the U.K.

- We will continue to review the rating in light of further information over the coming months about the extent of the expenditure-led fiscal consolidation.

On July 12, 2010, Standard & Poor’s Ratings Services affirmed its ‘AAA’ long-term and ‘A-1+’ short-term sovereign credit ratings on the United Kingdom (U.K.).

The outlook remains negative.

The transfer & convertibility assessment for the U.K. is ‘AAA’.

Sempre più una farsa.