Agosto 8, 2010 EcoAnemia

Situazione difficile in Russia

Il dato più importante ed atteso è stato sicuramente il NFP, assai deludente :

July Non Farm Payrolls miss expectations, coming in at -131,000, way below the consensus of -65,000, yet the unemployment rate drops once again to 9.5% as even more people drop out of the labor force.

Total Private Payrolls rise only 71k, on consensus estimates of +90k.

The June Jobs report is revised majorly downward to -221K, from -125K, as the double dip gets yet another validation.

The 2 Year Treasury just hit another fresh all time low of 0.5136%. And the stunner: those working actually declined by 159,000 to 138.960 million, even as another 381 thousand left the labor force between June and July, resulting in an actual drop in the unemployment rate from 9.6% to 9.5%.

Another NFP debacle which will certainly cause stocks to sure by at least 5% as QE 2 is now absolutely inevitable.

U-6, or real unemployment, is flat at 16.5%

The average duration of unemployment is now 34.2 weeks, Median 22.2

44.9% have been out of a job for longer than 27 weeks.

Birth/death adjustment just 7k, compared to 147k in June

The only silver lining: average hourly earnings up 0.2% to $22.59, even as total private hours increased from 34.1 to 34.2, as those employed have to do triple-duty

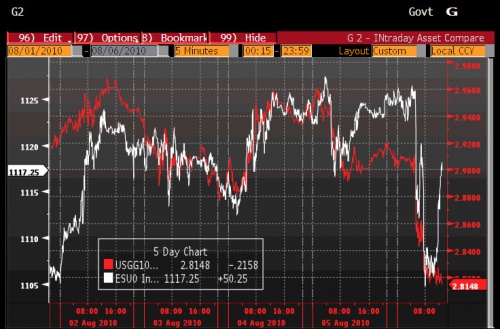

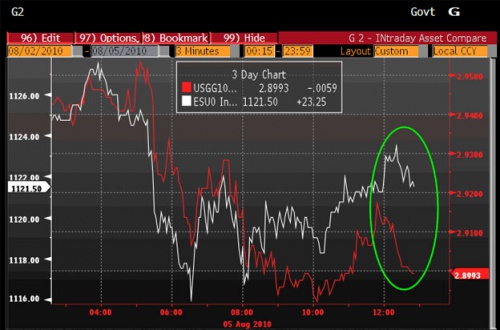

Dati certamente pessimi che prima hanno fatto scendere il mercato con alti volumi :

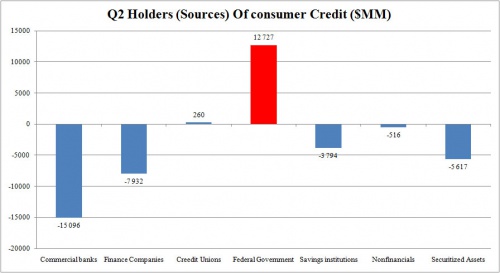

Poi è miracolosamente risalito come da pronostico nell’ultima ora sull’onda dell’HFT e della news del credit consumer in miglioramento, ma :

Solo acquisti della FED.

Ad ogni buon conto, lo Spoore ha chiuso poi vicino alla parità.

Per altro, tutti i dati macro usciti negli ultimi giorni non sono certo stati positivi :

Pending home sales came in at -2.6%, on hope and faith of even a modest rebound to the tune of 3.9%.

This of course came after last month’s plummeting (and revised) -29.9%. Factory orders also dropped to -1.2%, versus expectation of -0.5%, after the prior -1.4% reading. Lastly, the trifecta of ongoing bad news was completed as the June durable goods number was revised from -1.0% to -1.2%.

The week ended July 31 saw 479K initial jobless claims, obliterating the expectation of a minor improvement of 455K from the prior week’s 460K (revised from 457K). Continuing claims continue rising, and are now at 4537K versus expectations of 4515K.

Beni durevoli in calo, disoccupazione in aumento, vendita di case ancora in contrazione.

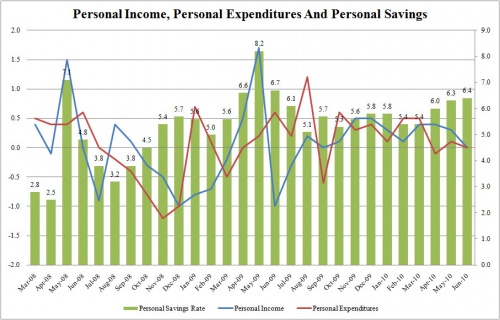

Ed i redditi personali ?

Il grafico vale più di ogni parola :

Questa quindi è solo una conseguenza :

The latest update from ICI shows that the week ended July 28 saw a record 13th consecutive outflow from domestic mutual funds as stocks bloody surged.

Good thing the HFT algos can now essentially communicate with each other in the actual unique flow patterns of cancelled stock bids, thereby announcing to all other participants the plans of one which promptly become those of all, in the most under the radar concerted effort to “club” the market’s HFT participants as one big trading force.

Per altro, anche il Baltic Dry Index pare avere finito il rimbalzo :

Per altro però, la direzione pare essere decisa, ed al momento non possiamo che prenderne atto fino a nuovi segnali, cioè verso Nord , il grafico di AMZN è eloquente :

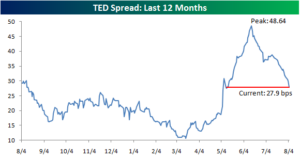

Il Ted Spread continua a scendere :

Ed anche se è illogico, tutto sale al momento :

Stocks surging ; Bonds surging ; Gold Surging.

Poco da aggiungere ad una visione generale :

E’ per altro evidente che ci sia qualche cosa che non quadra.

Tutto è una farsa, tutto è virtuale, l’esempio più eclatante è il declassamento di Moody’s da parte di S&P, da barzelletta se non fosse che è vero :

Standard & Poor’s Ratings Services assigned its ‘BBB+’ corporate credit rating to Moody’s Corp. We also affirmed the existing ‘A-2’ short-term rating. The outlook is stable.

At the same time, we assigned a preliminary ‘BBB+’ senior unsecured rating to Moody’s shelf registration. According to the company, it will use the proceeds for general corporate purposes, which may include debt repayment, acquisitions, and share repurchases.

Naturalmente va menzionata anche la speculazione sul Wheat future, questa però reale, che ha raggiunto livelli folli :

Moscow introduced export restrictions during the 2007-08 global food crisis, triggering a wave of panic buying from North Africa and Middle East importers.

The worst drought in more than a century in the Black Sea region has led to widespread alarm in the wheat market, with prices recording their sharpest rise since 1972, when Moscow bought almost all the available surpluses in the US to cover a domestic shortfall.

Forecasts for the Russian grain crop have been falling daily, with the agriculture ministry’s most recent projection at 70m-75m tonnes, down from 85m tonnes a fortnight ago.Some private sector analysts, however, believe the harvest will be as low as 63m tonnes. Traders at Glencore, the world’s largest commodity trading company, on Tuesday warned the crop could fall to about 65m tonnes.

Russia harvested almost 100m tonnes of grains last year.

C’è però da segnalare che la situazione in Russia pare davvero difficile.

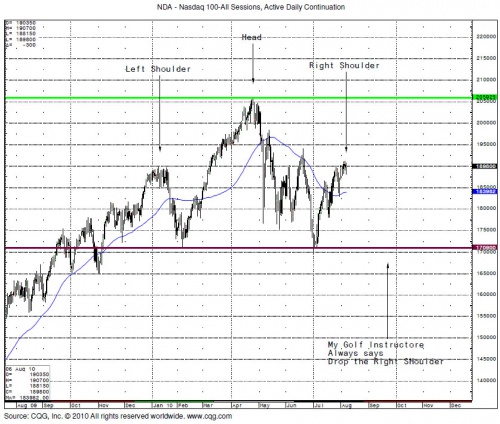

Se visto insieme al principale indice europeo, il Dax, questa potenziale configurazione in effetti può assumere interessanti connotazioni (anche se il tono generale è ancora bullish) :