Giugno 15, 2010 EcoAnemia

Strike three !

Semplicemente due diversi modi per vedere lo stesso risultato, anche se a mio avviso la rottura della MM200 è solo rinviata nel tempo : occorre ripristinare la fiducia presso il pubblico ed iniziare una nuova fase bull prima del declino che verrà.

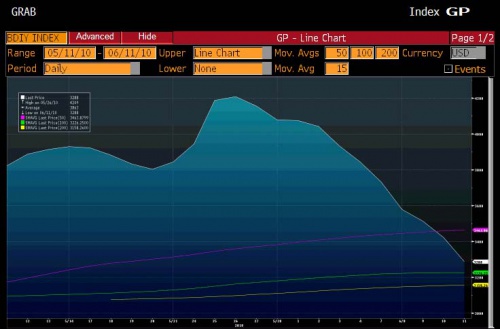

Mentre le condizioni macro peggiorano di giorno in giorno, ecco il Baltic dry Index, che fa segnare ancora una volta nuovi minimi :

Intanto la situazione macro in Europa continua a mandare segnali negativi : non solo Pimco ha deciso di sottostimare – per la prima volta dopo tantissimi anni – i suoi investimenti nel reddito fisso tedesco (non una novità, ma una dichiarazione pubblica fa sempre scalpore), ma soprattutto la situazione della Spagna continua a peggiorare di giorno in giorno, dato che non accennano ad arrestarsi sia la corsa dei CDS a 3Yr, sia soprattutto lo spread con il Bund tedesco.

Mentre S&P ha ribadito (ce n’era bisogno ?) il rating di Junk-Bonds per la Grecia :

Moody’s Investors Service has today downgraded Greece’s government bond ratings by four notches to Ba1 from A3, reflecting its view of the country’s medium-term credit fundamentals.

Today’s rating action concludes the review for possible downgrade, which Moody’s initiated on 22 April 2010.

Moody’s has also downgraded Greece’s short-term issuer rating to Not-Prime from Prime-1. Greece’s country ceilings for bonds and bank deposits are unaffected by the review and remain at Aaa (in line with the Eurozone’s rating).

The outlook on all ratings is stable.

Oggi è da segnalare invece l’outlook assai pessimistico di AXA sulla possibilità di riuscita di bailout dell’UE :

The markets are very nervous because they can see that there is a fatal flaw in the system and no clear way out. We are in a very major crisis that has even broader implications than the credit crisis two years ago.

The politicians have not yet twigged to this.” Ms Zemek said the rescue had bought a “maximum” of 18 months respite before deeper structural damage hits home, with a “probable” default by Greece setting off a chain reaction across Southern Europe.

“It would be the end of the euro as we know it.

The long-term implications are at best a split in the eurozone, at worst the destruction of the euro. It is not going to end happily however you slice it.“

Insomma, l’ottimismo è il profumo della vita, soprattutto se paragonato alle parole dei politici europei, ecco le ultime dichiarazioni a riguardo della Merkel :

Spain and other countries know they can use EU mechanism if needed.

“We hope this is not another diplomatic overture that hopes to set the market at ease.

We are fully confident that Spain knows too well it will soon have no option but to follow in Greece’s footsteps, as at some point its banks will have to roll tens of billions in Commercial Paper which are completely frozen courtesy of a dead interbank lending market”.

Blablabla, ed ecco il perchè in questo momento – nello short term – l’€ deve “forzatamente” recuperare, le ragioni le ribadisce – ancora una volta, se non fosse chiara a sufficienza la situazione – Zerohedge :

With a near record number of EURUSD short contracts outstanding, traders should be wary of massive short covering episodes, although the fate of the EUR, just like that of the US market at this point, are both guaranteed.

We will present tomorrow’s ECB deposit facility usage as it becomes available. Following today’s all time record of €384 billion, at this point the death of European interbank liquidity is a certainty, and unlike the US, as Bank of America points out (and as we will touch upon tomorrow), there is no simple, and US-comparable “print money” solution. Europe is on now its own.