Luglio 14, 2010 EcoAnemia

That’s all

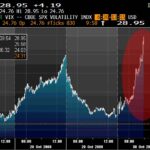

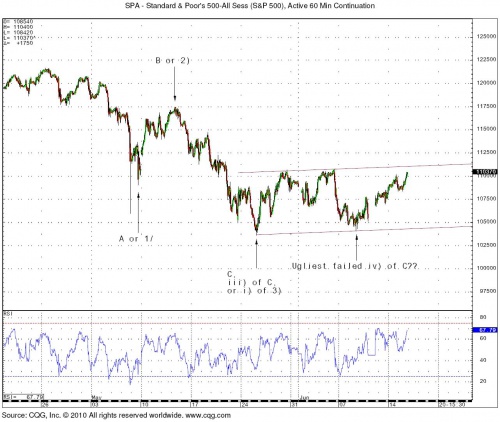

Siamo arrivati con la seduta di ieri sera al “point of no return” :

Al solito il volume non c’è, ed oggi apriamo quasi sicuramente in gap-up …

1097 è la resistenza da tenere presente in close di oggi, importante per capire come si evolveranno le prossime sedute .

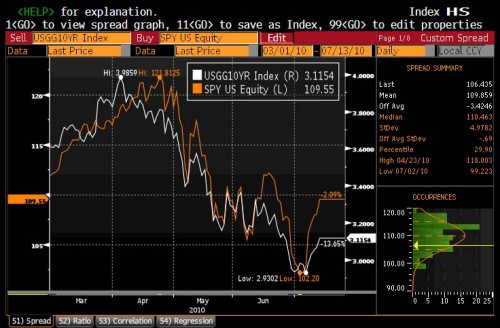

Interessante notare ancora lo spread esistente fra il 10Yr T-Bonds e lo Spoore, in che modo nei prossimi giorni si chiuderà ?

Nel frattempo, ieri i mercati sono volati al rialzo alla notizia del nuovo taglio di rating di Moody’s al Portogallo :

Moody’s Investors Service has today downgraded Portugal’s government bond ratings to A1 from Aa2. The two-notch downgrade reflects the rating agency’s following conclusions:

1.) The Portuguese government’s financial strength will continue to weaken over the medium term, as evidenced by ongoing deterioration in the country’s debt metrics, such as debt to GDP and debt to revenues; and

2.) The Portuguese economy’s growth prospects are likely to remain relatively weak unless recent structural reforms bear fruit over the medium to longer term.

The rating outlook is now stable, with the upside and downside risks evenly balanced.

Iniziano inoltre ad arrivare le prime reali indiscrezioni sugli stress-test riguardo le banche europee , come ci ricorda Zerohedge :

23% Haircut On Greek Debt… Held In Trading Books .

After all Europe’s central bank is on the hook for over $1 trillion in impaired debt now – does this mean the central bank will in no way be subject to any haircuts or other viability tests? Why of course, how else will flagrant lies about financial system’s stability be perpetuated for at least one more year.

Mah…

Mentre i dati macro continuano a peggiorare :

The National Federation of Independent Business Index of Small Business Optimism lost 3.2 points in June falling to 89.0 after posting modest gains for several months.

Allo stesso modo ieri è calato lo ZEW tedesco, ma questo dato è stato completamente ignorato dal mercato…

Mentre il Baltic Dry cala ancora vistosamente :

That’s all.