Aprile 16, 2008 EcoAnemia

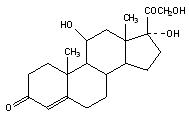

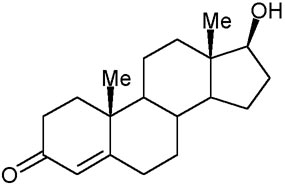

Traders and hormones

Could this upward surge of testosterone, cockiness and risky behaviour also occur in the financial markets ?

This was a question I asked while working on Wall Street during the dotcom bubble.

Many traders at this time displayed manic behaviour and a sense of infallibility.

Equally telling was that women appeared relatively unaffected. Both facts implicated a chemical such as testosterone. […]

Cortisol, a stress hormone, told us a different story.

When reacting to a challenge, cortisol slows down long-term functions of the body, such as digestion and reproduction, marshals glucose for immediate use and promotes an anticipatory arousal.

Cortisol reacts with particular force under conditions of novelty and uncertainty.

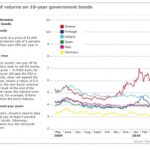

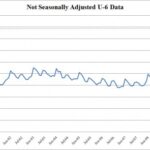

We found that cortisol rose with the variance of the trader’s profits.It also rose in lockstep with implied volatility in the options market, raising the intriguing possibility of a biological substrate for the derivatives market.

Cortisol was preparing traders for an impending market move; like testosterone, it was highest and most volatile in experienced traders. They appear cool and unemotional, but beneath the poker face is an endocrine system on fire.

Cortisol and testosterone, it appears, are the chemical messengers our bodies use to signal economic risk and return.

Moderate levels of steroids prepare traders for taking risks, but higher levels can impair judgment.

If testosterone continued to rise it could, by fostering over-confidence and risk-seeking, lead traders to make irresponsible trades. Testosterone is likely to rise in a bull market, increase risk and exaggerate the rally.

Chronic cortisol exposure, on the other hand, promotes feelings of anxiety, a selective recall of disturbing memories and a tendency to find danger where none exists.

Cortisol is likely to rise in a crash, make traders dramatically and perhaps irrationally risk-averse, and exaggerate the sell-off[…]

Per cui, stando ai risultati di questa statistica, verrebbe fuori che le bolle speculative sarebbero causate da un eccesso di testosterone, e che nei giorni in cui il testosterone è più alto e maggiore è il livello di rischio più in teoria si dovrebbero fare dei profitti.

Attendibilità statistica : zero.

Anche perchè l’influenza degli ormoni sull’umore è nota da sempre,e sono tutti sistemi a feedback.

Per cui mi permetto di dissentire da questa balzana teoria, dato che l’assunzione di medossiprogesterone, estradiolo, ciproterone & finasteride è oramai da diversi anni compagna fedele della mia vita.

Inoltre i feedback che arrivano da Goldman Sachs e Bank of America paiono andare nella direzione opposta.

Se fosse realmente così, i migliori speculatori nazionali starebbero a Pontida.