Marzo 25, 2010 EcoAnemia

Tutto gira intorno ai cambi

Ieri due importantissimi fatti dal punto di vista macro.

Il primo riguarda l’Europa, con Fitch che ha downgradato il rating di un altro stato sovrano, il Portogallo :

Fitch Ratings has downgraded Portugal’s Long-term foreign and local currency Issuer Default Ratings (IDR) to ‘AA-‘ from ‘AA’.

The agency has simultaneously affirmed Portugal’s Short-term foreign currency rating at ‘F1+’ and Country Ceiling at ‘AAA’. The Outlooks on the Long-term IDRs are Negative.

Le ragioni sono più o meno le solite :

The downgrade reflects significant budgetary underperformance in 2009.The general government deficit in that year was 9.3% of GDP, versus 6.5% of GDP forecast by Fitch last September.

This has significantly increased the scale of the fiscal challenge to stabilise and reduce debt over the medium term.

The government will need to implement sizeable consolidation measures from next year, on top of the reversal of the fiscal stimulus this year, in order to meet the 3% of GDP deficit target by 2013. If this is achieved, public debt/GDP will peak at around 90% in 2013

La seconda arriva invece direttamente dagli USA, la vendita di nuove abitazioni raggiunge un nuovo record negativo di tutti i tempi :

New home sales drop to a record low adjusted annual rate of 308K.

Existing home sales inventory surges to nearly 9 months, not counting the shadow inventory, which is more than double.The plunge is in all regions except the West, where the pick up was from 77K to 93k.

Le più importanti implicazioni si sono viste nel Forex, dove immediatamente il DXY si è rafforzato, con Goldman Sachs che pubblicamente afferma di essere stata stoppata al rialzo (ma sarà vero ? io non ci credo) :

Slightly less than two weeks ago we initiated a long EUR/$ trade recommendation on the basis of three factors.

First we anticipated a notable improvement of cyclical growth news in the Eurozone, second we highlighted the continued USD negative BBoP flows and finally, we assumed that the Greece risk premium in the Euro would stabilise and decline.

While broadly correct on the cyclical news, where the latest round of European business surveys point to strong momentum, we have clearly underestimated the impact on the EUR from the European sovereign crisis and perhaps also from the broader macro adjustment that it portends.

The latest developments suggest the building consensus among Eurozone members is becoming increasingly difficult. These political headwinds currently matter far more for the Euro than the cyclical factors.

We were stopped out of EUR/$ for a potential loss of 2.8% (opened at 1.3740, closed at 1.3350). Given we also carry significant EUR/$ exposure in our short $/PLN recommendation, we decided to also close this idea for a small potential gain of 0.6%.

Uhm, quando GS afferma una cosa solitamente sta facendo – o farà – l’opposto.

Nel frattempo, tutti in questo momento sono pubblicamente contro l’€ , compreso John Taylor (che non è l’ex bassista dei DuranDuran, ma il gestore di FX Concept, uno dei più grossi hedge fund che opera nei cambi) :

“It’s going to be quick because things are really falling apart.

Some of these [countries] have to be thrown out [of the EMU].

If you look at a country like Latvia, which has been effectively in the Euro, has been saved by the European Commission and the IMF much like they are suggesting Greece will be, their retail sales were down 30% last year, the GDP was down 18%, it is expected to drop another 8% this year.

Latvians are starving, the place is a disaster area : that’s what you have to go through to be a part of the Euro.

Perchè , tutte queste sono delle novità ?

E le Lettonia mica fa parte dell’€.

Il target che dà all’€/$ è 1.20 per Agosto.

In ogni caso, molto interessante l’intervista, che la si può sentire e vedere qua :

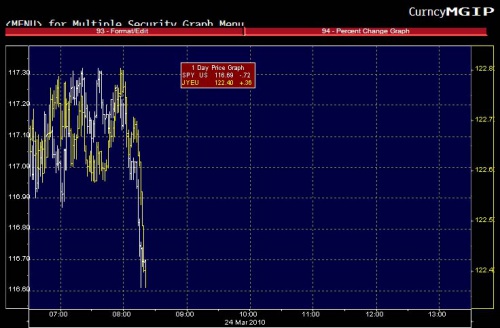

Molto più interessanti invece le implicazioni sul cambio €/yen :

Carry-trade del momento, e come già segnalato più volte, nella sessione diurna ricalca fedelmente l’andamento dello Spoore.

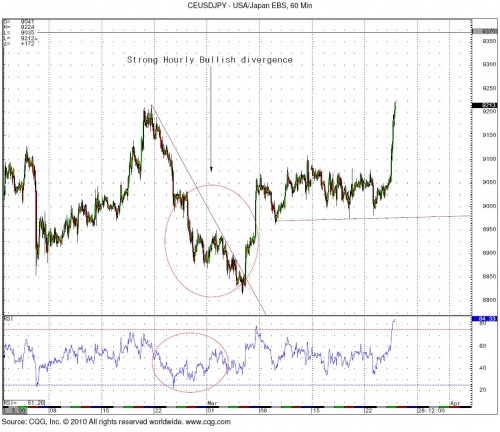

Mentre sul cambio $/Yen, potrebbe essere vicino un cambio di trend, come si può evincere dai seguenti grafici :

Oggi come non mai la chiave sta proprio nei cambi.