Febbraio 25, 2010 EcoAnemia

Tutto il resto oggi è superfluo

I mass media naturalmente non ne parlano, ma il fatto principale della giornata di ieri è questo, avvenuto quando da noi era già notte :

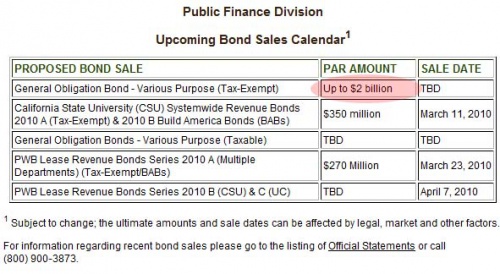

[…]CA cancels $2b bond sale after legislature fails to approve cash management flexibility bill Treasurer said he needed to attract investors.[…]

Did California think it would succeed where so many other high yield issuers have recently failed ?[…]

La California è sull’orlo del baratro, esattamente come la Grecia, la differenza è che nessuno ne vuole parlare.

Ma le dimensioni di questo oramai sempre più possibile default sarebbero catastrofiche.

Ed infatti, ecco che la SEC cerca – in modo assolutamente puerile ed inutile – di inserire ciò che nei mercati azionari USA non è mai esistito, cioè una specie di sospensione al ribasso :

[…]the SEC just voted 3-2 to institute the short-selling rule which will put curbs on shorting individual securities that fall over 10% in any one day[….]

Una misura che naturalmente non serve a nulla, ma si sa che devono essere sempre favoriti gli insiders – che naturalmente venderanno in anticipo prima della sospensione del 10%.

Complimenti vivissimi, ma anzichè cercare muove misure inutili , non si potrebbero fare rispettare quelle che ci sono, tipo vietare gli short selling naked (come appunto capita a tutti i comuni mortali di questa terra, tranne i soliti noti tipo GS, MS, WFC e simili).

Ci sarà da divertirsi quando la regola diventerà definitiva.

Nel frattempo, pessimo dato di vendita delle nuove case, record storico negativo di tutti i tempi :

[…]Demand for single-family homes fell 11.2% from the previous month to a seasonally adjusted annual rate of 309,000, the Commerce Department said Wednesday.

Economists surveyed by Dow Jones Newswires had estimated sales would rise 3.8%, to 355,000.

It was the third drop in a row. Sales in December fell 3.9%, revised from an originally reported 7.6% decline.The 11.2% decrease carried sales to their lowest ever. Records began in 1963. Sales fell below the level of 329,000 in January 2009 that analysts had considered the bottom for the market. […]

Chi si aspettava una ripresa del mercato immobiliare, è rimasto naturalmente molto deluso, ma – si sa – è più facile sperare in una illusione che utilizzare il proprio cervello.

Ed è da segnalare l’ennesima perdita netta operativa per Freddie Mac :

[…]Freddie Mac Reports Q4 Loss; Another $5 Billion In Taxpayer Money Out The Window To Support Fake Home Prices […]

Indebitandosi sempre di più allegramente, e tenendo oramai da anni artificialmente in vita una società ridotta ad uno zombie, esattamente come la sorella Fannie Mae, ma che è “too big to fail”.

E mentre anche S&P, dopo Moody’s , fa un oramai inutile downgrade al debito greco :

- Downside risks for Greece’s real and nominal growth are likely to increase the size of needed fiscal consolidation, raising questions about the feasibility of the country’s ambitious budgetary goals.

- Political risks for the timely implementation of the entirety of fiscal reforms continue to be material.

- We are maintaining our ‘BBB+/A-2’ ratings on the Hellenic Republic on CreditWatch negative.

- The negative CreditWatch implications reflect the possibility of a further downgrade of one to two notches within a month.

Si ricominciano a vedere anche in questo caso le scene già viste in passato in situazioni simili :

[…] Wealthy Greeks have moved around EUR8 billion out of local banks in the past three months fearing a possible new tax on bank accounts, increased government scrutiny on assets and a run on the banks if Athens is forced to turn to the International Monetary Fund, according to private bankers and other people with knowledge of the situation. […]

Ed anche :

[…]”There is a lot of uncertainty out there”, said a senior private banker at a Greek bank.[…]

Ma va ?

[…] “We’ve had a number of customers asking to move funds out of Greece, mostly to Cyprus, Luxembourg and Switzerland.”[…]

Che strano.

[…] “We estimate that EUR8 billion has moved out of Greece to accounts abroad since December.

It’s money from bank accounts, stock sales, property sales and other sources. This is pretty substantial considering that there is only EUR30 billion under management in private banks here“[…]

Oops.

[…]“Some of our clients are concerned about a run on the banks if the IMF gets involved,” said another private banker, this one from a foreign bank. “They believe the situation in Greece will get worse before it gets better.[…]

Chi mastica qualche cosa di economia e finanza ed utilizza la logica ha già preso in Grecia le contromisure, naturalmente, perchè la storia si ripete sempre nel medesimo modo.

[…] Finance Minister George Papaconstantinou earlier this month [as in February] urged Greeks with accounts abroad to repatriate their money and said the capital will be taxed at a 5% rate.

He said those who choose to keep their money abroad should declare their deposits and pay a tax of 8% for the first six months.Thereafter he threatened that Greece will use all laws at its disposal, such as double-taxation agreements, to ask foreign banks for information on Greek account holders. […]

E questo cosa vi ricorda ?

Ed infatti :

[…] The quotes attributed to private bankers are not sourced but that is usually the case.

We have heard of some ship owners for instance moving assets to Cyprus and Switzerland too, so this part of the story is not far fetched.

The key point however is not the health of banks here but that the money and asset transfers are a move to avoid higher taxes[…]

Tutto il resto è superfluo.