Aprile 23, 2010 EcoAnemia

Una Unione Europea che non è mai esistita

Prima di addentrarci nell’analisi della bancarotta greca (oramai solo da ufficializzare tecnicamente), è interessante notare un fatto importante che ci mostrerà il prossimo grafico, cioè l’indifferenza totale degli indici USA a questo evento.

Non ci deve per nulla stupire, dato che una crisi finanziaria in Europa al momento non può che portare benefici oltreoceano, anche se da loro la situazione interna scricchiola vistosamente.

Le trimestrali fioccano positive, e per certi versi alcune società stanno avendo un comportamento assai simile a quello visto ai tempi della bolla delle dot.com :

Impressionante vedere come una società come Netflix in questo momento stia capitalizzando di più del PIL greco.

Il real estate torna piano piano ai massimi.

Starbucks vola dopo una buona trimestrale.

Sandisk idem.

Ma non solo tech.

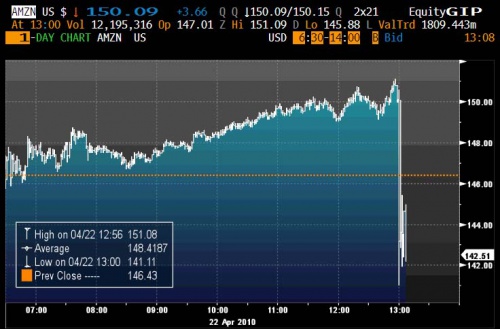

E se ieri sera dopo l’annuncio della trimestrale, AMZN ha perso il 5% :

Per altro con numeri piuttosto buoni :

Net sales are expected to be between $6.1 billion and $6.7 billion, or to grow between 31% and 44% compared with second quarter 2009.

Operating income is expected to be between $220 million and $320 million, or to grow between 39% and 102% compared with second quarter 2009.

The second quarter 2009 results include the impact of our settlement with Toysrus.com LLC for $51 million, substantially all of which was expensed during the quarter.

This guidance includes approximately $130 million for stock-based compensation and amortization of intangible assets, and it assumes, among other things, that no additional business acquisitions or investments are concluded and that there are no further revisions to stock-based compensation estimates.

Ma sono anche da segnalare i numeri particolarmente interessanti di AXP :

Thursday, credit card service provider American Express Co. said its first quarter profit more than doubled from last year, helped by the strong performance in the U.S. Card Services division and a sharp decline in loan loss provisions.

E soprattutto di COF, che infatti nell’after hours ha fatto +10% :

Capital One Financial Corp., Thursday reported a surge in first quarter profit, as higher interest income and customer related fees helped offset increases in loan loss provisions.

Net income available to common shareholders of the McLean, Virginia-based company was $636.26 million or $1.40 per share, compared with a loss of $172.25 million or $0.44 per share in the same quarter a year ago. Sequentially, in the fourth quarter, the company’s profit was $375.6 million, or $0.83 per share.

Ed è per altro interessante notare che per la prima volta dopo 23 anni i profitti del gigante MSFT scendono :

Microsoft have announced their Q1 2009 financial results, and for the first time in 23 years the company has seen its profits drop.

Revenue from the three-month period was $13.65bn, down 6-percent from Q1 2008, with net income down 2-percent over the same period, to $2.98bn.

According to Microsoft, the culprit is the burgeoning netbook niche.Sales of netbooks have been brisk – though perhaps not as much as manufacturers themselves might have hoped – but their general use of the cheaper Windows XP rather than Vista has punched a hole in Microsoft’s profits.

In response, Microsoft have reiterated their launch schedule for Windows 7, targeted for release in the 2010 financial year, which should prove more capable on netbook-style machines.

Per altro, visto il successo attuale dei Mac e soprattutto la qualità davvero scadente – ma mai ce l’hanno avuta buona ? – della chiavica (S)Vista e del deludente 7, era abbastanza scontato.

Così come continua la crisi – se così si può parlare, di Nokia, ieri -14% dopo numeri non buoni :

Nokia has released their Q1 2010 results, reporting an operating profit of €488 million, with net sales €9.5 billion (up 3% YoY).

Nokia’s device and service division’s profits were €831 million, up 52% year on year.

Margins in devices and services were 12.1% (up 1.3% YoY and down 5% QoQ).

Converged devices sales (smartphones) were 21.5 million, compared with 13.7 million units in Q1 2001 (up 57% YoY) and 20.1 million units in Q4 2009 (up 3%).As such, worldwide smartphone marketshare was 41%, up 1% sequentially and 3% year on year.

Tornando invece agli indici, interessante notare come siamo davvero ad un punto critico :

Lo Spoore, come fatto notare più di una volta, è giunto in prossimità del 61.8% di Fibonacci, resistenza che a mio parere si rivelerà piuttosto tosta.

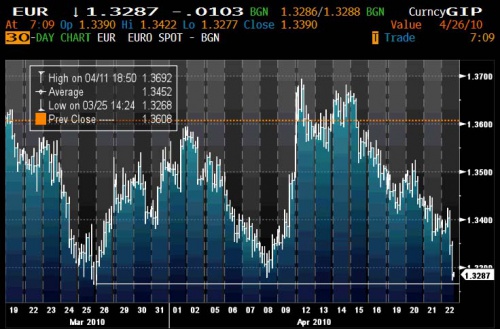

Mentre l’€ – specchio di una UE che di fatto non esiste se non sulla carta, sta sprofondando inesorabilmente :

Segno di un fatto intangibile, come ha fatto notare giustamente ZeroHedge :

- This has been tried many times already

- This is just a DIP loan and all the existing debt gets primed.

- Congrats Greece – you are now officially bankrupt.

Sì, è proprio così, fine della storia, la Grecia è andata in bancarotta.

Il target è quello già segnalato da tempo, intorno agli 1.20 (naturalmente si tratta di valori indicativi), momento in cui gli USA saranno costretti ad inondare di $$ il mondo se non vorranno rapidamente tornare in recessione.

Per la Grecia è definitivamente game over, il mercato parla chiaro :

EuroStat reports that the Greek budget was really 13.6% of GDP and the Debt/GDP is more like 115.1%. Greek bond spreads explode to a ridiculous 562 bps on the news, 3 years are at 870, and 5 year CDS is at 565.

Greek 3 Year Bonds Yielding 11.3%

E la Germania, se ce ne fosse bisogno, ribadisce ancora :

As German Party Member Says Greece Needs Further Austerity Or Should Leave Eurozone

Da leggere fra le righe questa dichiarazione, al solito, visto che la la situazione interna è questa :

[…]if you are a baker, waiter, hairdresser, or radio presenter in Greece you qualify for early retirement.

Taxes optional along the way.

Oh, and throw in the most generous pension system in Europe: 11.6% of GDP goes to pension coverage (24% in 2050), and one can see why every IMF involvement will bring the country closer to civil way.

Il Titanic sta affondando, e Moody’s mette il dito sulla piaga, inventandosi un nuovo, pleonastico downgrade sulla Grecia :

Moody’s Investors Service has today downgraded the government bond ratings of Greece to A3 from A2 and placed them on review for further possible downgrade.

This decision is based on Moody’s view that there is a significant risk that debt may only stabilise at a higher and more costly level than previously estimated.

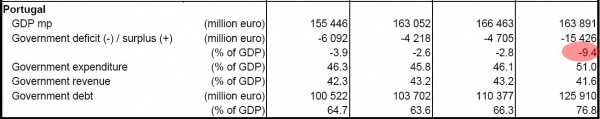

Per altro, il contagio si sta diffondendo, non solo la Grecia, ma pure il Portogallo ha i conti taroccati (in verità, che cosa non è taroccato oggi di ufficiale nel nostro mondo ?).

Un giorno dedicherò un post solo a questo argomento) :

EuroStat report which presents an “objective” look at various countries’ realistic debt and budget deficit pictures sans governmental propaganda and lies.

And while Greece is getting pounded for good reason, another country where the discrepancy between estimates and reality was even worse is Portgual, whose deficit EuroStat disclosed at -9.4%, on expectations of a -8% number.

In the meantime Goldman is reaping a veritable bonanza trading 1 Year Greek CDS (which is at 900 bps) which now has a 200 bps bid/ask spread !

Other entities getting bushwhacked as a result include Ireland, which is 23 wider at 173 bps (nothing flattering about the Irish in the EuroStat report either), and Banco Comercial Portugues SA which is 38 bps wider to 297.

PIIGS are officially in freefall after the truth has finally set them free.

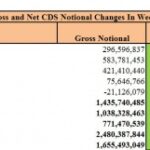

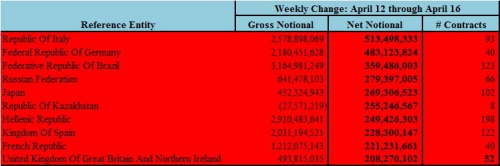

Beh, credo ci sia ben poco da aggiungere, se non che immediatamente sono iniziate le speculazioni sui CDS degli altri PIIGS :

The fear about the Eurozone continues, only this time spreading increasingly to the core.

While the Italy move of over half a billion in net notional increase is not surprising, as many perceive the nation as the next weakest link after Greece and Portugal, the German spike is a little surprising, although less so when one considers the failed 30 year Bund auction yesterday.

Other countries that fill out the list of top 10 deriskers in the prior week include Brazil, Russia, Japan, Kazakhstan, Greece (yup, they’re back), and the UK

Eh, sì, anche la Germania è nel mirino, non tanto per la sua solidità, ma per questioni pratiche, leggere € a pezzi.

E non solo Italia, ma anche Francia vista nelle medesime condizioni (oltre alla ben nota e conciata in modo peggiore Spagna).

Tempi duri ci attendono, nonostante gli indici USA abbiano ancora paradossalmente degli spazi di salita.