Ottobre 11, 2008 EcoAnemia

Vendite forzate di basket

“It seems that the major catalyst for this selling is the fact that the newest large banks primarily J. P. Morgan, Goldman Sachs, and possibly Morgan Stanley as well — have issued massive margin calls to hedge funds and other professional traders who use these banks as prime brokers.

These calls were not issued because of market losses, but more because the banks arbitrarily decided that they wanted their customers to use less leverage.

Margin rates as low as 15% for broker dealers were raised to 35%; hedge funds who had been used to operating on high leverage were told that they had to bring accounts up to a much larger percentage of equity.

In this illiquid environment, where all manor of exotic securities literally have no bids, the only place to raise the cash to meet margin calls was to sell stock.

That is what really set this market over the edge — as the first notice of these calls were issued on October 2nd and 3rd

There was something of a grace period to meet the calls, but funds realized they weren’t going to be able to meet them other than by selling stock.

There are rumors that the most massive of the calls are due Monday (October 13th).

If so, this market could continue to decline through then.”

Fonte : Bloomberg.com

Hanno sguazzato nelle bolle, provocando il disastro.

Sono sopravvissuti.

Ed ora stanno distruggendo tutto.

Cosa vogliono ottenere ?

La loro sopravvivenza.

Del resto non gliene frega nulla.

MS e GS già sono assai malandate di loro : in più si sono accollate altra tossicità dalle banche defunte.

Non c’è liquidità e dovranno cercare di riavvicinarsi ai ratios.

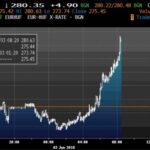

Ma anziché aumentare i margini dal 15% al 35% sui massimi – sarebbe stata la cosa sensata – hanno deciso di farlo nel momento peggiore: il 2-3 ottobre.

Amplificando in maniera impressionante il crollo dei mercati – con gli hedge che avevano naturalmente capito tutto.

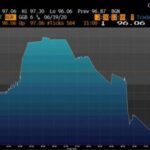

Le vendite fino a stasera più i giochetti sporchi sul forex e le materie prime (travolti pure Gold e Silver che nei momenti di crisi dei mercati solitamente dovrebbero fare nuovi massimi e non minimi) rendono il quadro assolutamente chiaro.